9 Best Renovation Loan in Singapore to Save Costs [2025]

Want a new look for your house but is worried about the costs?

Getting your new house soon and found the best interior designer you would love to work with? Or have you been working at home for too long and thinking about renovating your home for a new look? In both cases, the next consideration point will be “can you afford the renovation costs”?

The renovation costs for a standard 4 room hdb will cost around S$50,000 excluding furnishing and apppliances. Not many people has the flexibility to instantly take out such a large sum of cash to spend it on renovations. Usually, they will consider getting a renovation loan in Singapore from financial instituation or licensed moneylenders to spread out the cost.

If you are unsure of where to look for the best renovation loan for you, worry no more!

In this article, we have created a list of the 9 best renovation loans in Singapore to help you save costs.

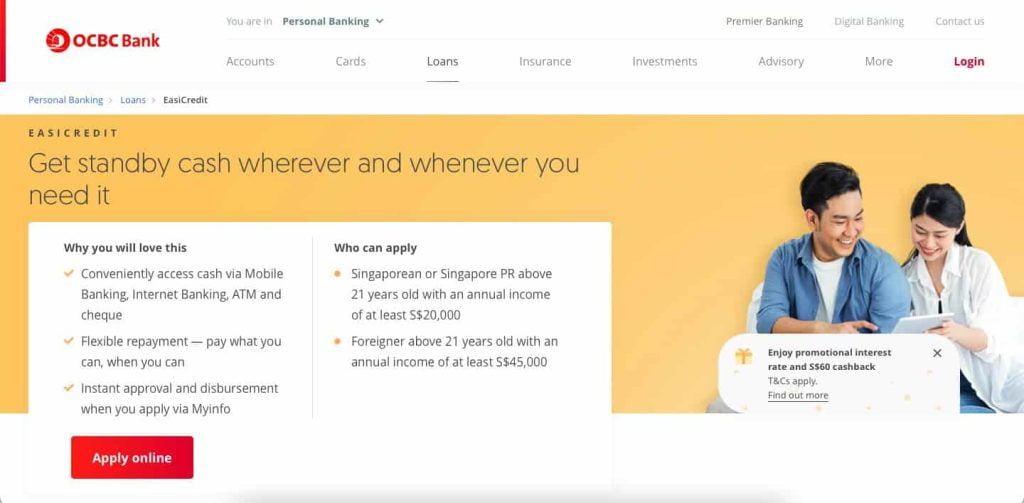

1. OCBC EasiCredit

| Type of Information | Details |

| Website | https://www.ocbc.com/personal-banking/loans/easicredit-flexible-repayment-cash-loan |

| Contact | +65 6363 3333 (24 Hours) |

| Highlights to Note | – Flexible repayment period and loan tenure – Approval and disbursement is almost instantly when you apply via Myinfo – Eligibility: Singaporean / Singapore PR above 21 years old with an annual income of at least S$20,000 OR Foreigners above 21 years old with an annual income of at least S$45,000 – Apply for EasiCredit online before 30 June 2021 to get S$60 cashback and a promotional interest rate of 6% per annum from now till 30 September 2021 – Annual fee waiver for your EasiCredit account up till the age of 29 |

OCBC EasiCredit provides convenient access to cash via Mobile Banking, Internet Banking, ATM, and cheque. The repayment period and loan tenure are also flexible. OCBC EasiCredit approval and disbursement is almost instantly when you apply via Myinfo.

You are eligible to apply for this loan if you are a Singaporean or Singapore PR above 21 years old with an annual income of at least S$20,000. For foreigners, you would need to be above 21 years old with an annual income of at least S$45,000.

The maximum loan, interest rate, and minimum repayment is based on your annual income, as per the table shown below:

For annual income | S$20,000 – S$29,999 | S$30,000 – S$119,999 | S$120,000 and above |

Maximum loan | Up to 2x your monthly income | Up to 4x your monthly income | Up to 6x your monthly income |

Prevailing interest rate | 29.80% per annum | 20.90% per annum | 20.90% per annum |

Minimum repayment | 5% of outstanding amount OR S$50, whichever is higher | 3% of outstanding amount OR S$50, whichever is higher | 3% of outstanding amount OR S$50, whichever is higher |

Moreover, OCBC is currently running a promotion for EasiCredit. If you apply for EasiCredit online before 30 June 2021, you can get S$60 cashback and enjoy a promotional interest rate of 6% per annum from now till 30 September 2021.

You can also enjoy an annual fee waiver for your EasiCredit account up till the age of 29!

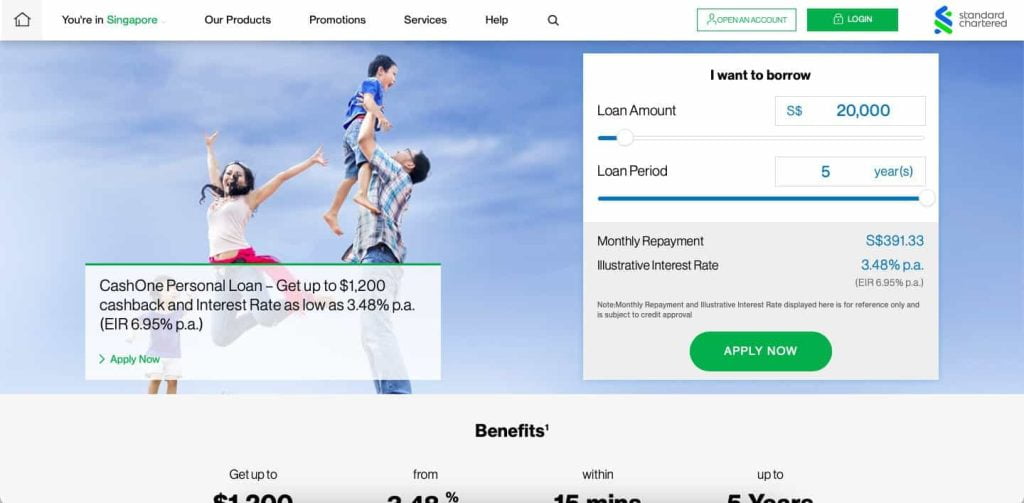

2. Standard Chartered CashOne

| Type of Information | Details |

| Website | https://www.sc.com/sg/borrow/loans/cashone/ |

| Contact | +65 6747 7000 (24 Hours) |

| Highlights to Note | – Get up to $1,200 cashback and interest rates as low as 3.48% p.a. (EIR 6.95% p.a.) – Loan disbursed within 15 minutes to any existing bank account of your choice – Flexible repayment loan tenure from 1 to 5 years – Eligibility: aged between 21 to 65 years – For Singaporeans and Singapore Permanent Residents, your minimum annual income needs to be S$20,000 – For foreigners, your minimum annual income needs to be S$60,000 and you must hold a Singapore Employment Pass – For existing Standard Chartered credit cardholders, no documents are required for the application of this loan – From now till 30 June 2021, will match any personal loan rate you received from a competitor bank |

Standard Chartered CashOne Personal Loan lets you get up to $1,200 cashback and interest rates as low as 3.48% p.a. (EIR 6.95% p.a.) Your loan will also be disbursed within 15 minutes to any existing bank account of your choice. Similar to other banks, there is also a flexible repayment loan tenure from 1 to 5 years.

The cash back works according to the table below:

Approved Loan Amount | Tenure (Years) | New Client Cashback | Existing Client Cashback |

S$5,000 to $9,999 | 3, 4 or 5 | – | – |

S$10,000 to S$20,000 | 3, 4 or 5 | S$200 | S$100 |

S$20,001 to S$50,000 | 3, 4 or 5 | S$300 | S$200 |

S$50,001 to S$100,000 | 3, 4 or 5 | S$600 | S$500 |

S$100,001 to S$250,000 | 3, 4 or 5 | S$1200 | S$1000 |

You are eligible for this loan if you are aged between 21 to 65 years. For Singaporeans and Singapore Permanent Residents, your minimum annual income needs to be S$20,000. For foreigners, your minimum annual income needs to be S$60,000 and you must hold a Singapore Employment Pass.

On the other hand, for existing Standard Chartered credit cardholders, no documents are required for the application of this loan. However, if there has been a recent change in your income, you would need to submit your updated documents for review during the application process.

On top of the above, Standard Chartered is running a promotion till 30 June 2021, where they are willing to match any personal loan rate you received from a competitor bank. All you have to do is text LOAN<space>MATCH to 77222.

3. CIMB CashLite

| Type of Information | Details |

| Website | https://www.cimb.com.sg/en/personal/banking-with-us/loans-financing/personal-loans-financing/cimb-cashlite.html |

| Contact | +65 6333 7777 |

| Operation Hours | Daily 9 am to 7 pm |

| Highlights to Note | – 1 to 5 years personal installment loan at rates from 3.50% p.a. – For new CIMB customers, applying for CIMB Platinum Mastercard online using the promotion code “CASHLITE” – For existing CIMB customers, enjoy the rates of 4.50% by applying CIMB Platinum Mastercard / CIMB Visa Signature / CIMB World Mastercard / CIMB Visa Infinite – Eligibility: Singaporean / Singapore PR with at least S$30,000 |

CIMB CashLite allows you to take up a 1 to 5 years personal installment loan, at rates from 3.50% p.a. The interest rates and loan tenure are shown in the table below:

Loan Amount S$1,000 and Above

Tenure (Years) | New-To-Bank Promotion | Existing Customers | ||

Interest Rate (p.a) | Effective Interest Rate (p.a.) | Interest Rate (p.a) | Effective Interest Rate (p.a.) | |

1 | 3.50% | 6.40% | 4.50% | 8.21% |

2 | 3.50% | 6.58% | 4.50% | 8.41% |

3 | 3.50% | 6.60% | 4.50% | 8.41% |

4 | 3.50% | 6.58% | 4.50% | 8.36% |

5 | 3.50% | 6.54% | 4.50% | 8.29% |

For new CIMB customers, you can enjoy the rates of 3.50% by applying for CIMB Platinum Mastercard online using the promotion code “CASHLITE”. Do note that you need to be a Singaporean or Singapore PR with at least S$30,000.

For existing CIMB customers, you can enjoy the rates of 4.50% by applying for the following credit cards. Do note that you also need to be a Singaporean or Singapore PR with at least S$30,000.

- CIMB Platinum Mastercard

- CIMB Visa Signature

- CIMB World Mastercard

- CIMB Visa Infinite

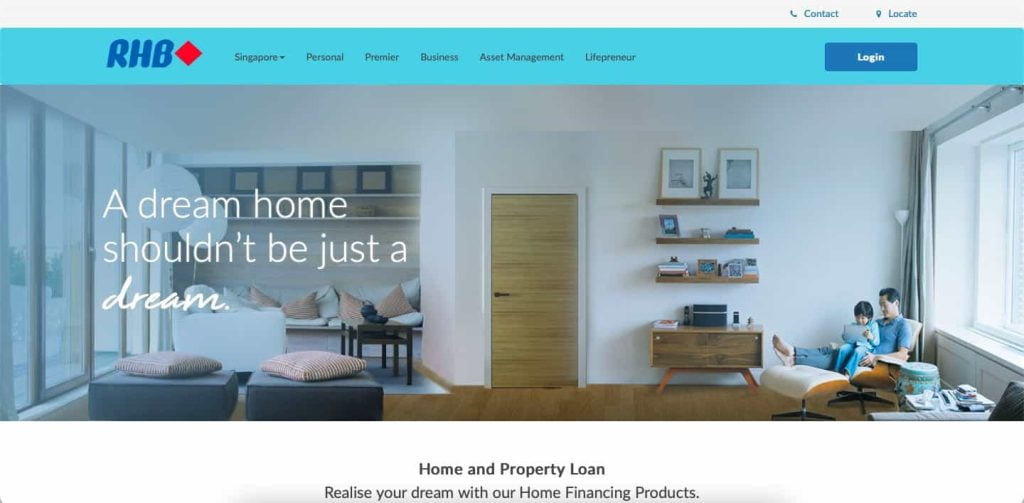

4. RHB Renovation & Furnishing Loan

| Type of Information | Details |

| Website | https://rhbgroup.com.sg/rhb/personal/home-and-property |

| Contact | 1800 323 0100 |

| Highlights to Note | – Flexible repayment period from 1 year to 5 years – Choose from Flat Rate Package / Monthly Rate Package – If the loan is still not enough, you can apply for Additional financing for home furnishings – Eligibility: Singaporeans / Singapore Permanent Residents between 21 to 55 years old – Main applicant must be earning at least S$30,000 per annum – Joint applicant must earn a minimum income of at least S$30,000 for the income to be computed as part of the loan quantum – Joint applicant must be gainfully employed and is a spouse, parent, sibling, or child of the main applicant – Either the main or the joint applicant must be the owner of the property to be renovated |

RHB Renovation & Furnishing Loan boasts of offering an amount up to 6 times your monthly salary or S$30,000, whichever is lower. The loan also provides a flexible repayment period from 1 year to 5 years. There are two interest rate packages to choose from, either a Flat Rate Package or a Monthly Rate Package.

Flat Rate Package

Loan Tenure | Loan Amount below $15,000 | Loan Amount $15,000 to $30,000 | ||

Interest Rate (%p.a.) | Effective Interest Rate (%p.a.) | Interest Rate (%p.a.) | Effective Interest Rate (%p.a.) | |

1 year | 3.68 | 8.60 | 2.98 | 7.32 |

2 years | 3.68 | 7.90 | 2.98 | 6.60 |

3 years | 3.68 | 7.60 | 2.98 | 6.31 |

4 years | 3.68 | 7.41 | 2.98 | 6.14 |

5 years | 3.68 | 7.27 | 2.98 | 6.02 |

Monthly Rate Package

Loan Tenure | Interest Rate (%p.a.) | Effective Interest Rate (%p.a.) |

1 year | 4.18% p.a. (Renovation Board Rate-4.07%) | 6.00 |

2 years | 4.18% p.a. (Renovation Board Rate-4.07%) | 5.11 |

3 years | 4.18% p.a. (Renovation Board Rate-4.07%) | 4.80 |

4 years | 4.18% p.a. (Renovation Board Rate-4.07%) | 4.64 |

5 years | 4.18% p.a. (Renovation Board Rate-4.07%) | 4.55 |

Additional financing for home furnishings

Loan Tenure | Interest Rate (%p.a.) | Effective Interest Rate (%p.a.) |

1 year | 8.80 (Prime Lending Rate+3.10) | 10.59 |

2 years | 8.80 (Prime Lending Rate+3.10) | 9.71 |

3 years | 8.80 (Prime Lending Rate+3.10) | 9.40 |

4 years | 8.80 (Prime Lending Rate+3.10) | 9.24 |

5 years | 8.80 (Prime Lending Rate+3.10) | 9.14 |

To be eligible for this loan, you need to be a Singaporean or a Singapore Permanent Resident between 21 to 55 years old. The main applicant must be earning at least S$30,000 per annum.

The joint applicant must earn a minimum income of at least S$30,000 for the income to be computed as part of the loan quantum. Also, the joint applicant must be gainfully employed and is a spouse, parent, sibling, or child of the main applicant. Lastly, either the main or the joint applicant must be the owner of the property to be renovated.

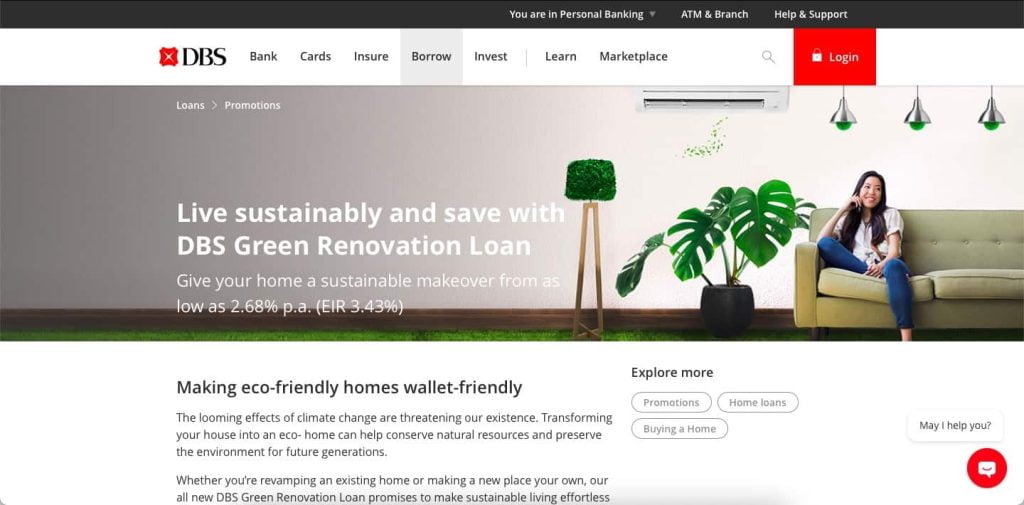

5. DBS Green Renovation Loan

| Type of Information | Details |

| Website | https://www.dbs.com.sg/personal/promotion/renoloan-promo |

| Contact | 1800 111 1111 |

| Operation Hours | Daily 8 am to 12 am |

| Highlights to Note | – Installing solar panels, home battery, or EV chargers: 2.68% p.a. interest rates and a S$100 rebate – Switching to a green utility provider: 2.68% p.a. interest rates and a S$30 rebate – DBS Home Loan Customer: 2.98% p.a. interest rates – Apply for Green Renovation Loan: 3.68% p.a. interest rates – To qualify for Green Renovation Loan, fulfil any 3 items which include using certified low-VOC paints, energy efficient lightings and ceiling fans instead of air-conditioners – Promotion will end on 30 June 2021 |

If you are planning to give your home a sustainable makeover, DBS Green Renovation Loan will be able to assist you with interest rates from as low as 2.68% p.a.

The more green you go, the lower your interest rates, as shown below:

| Loan Plan | Interest Rates |

| Installing solar panels, home battery or EV chargers | 2.68% p.a. interest rates and a S$100 rebate |

| Switching to a green utility provider | 2.68% p.a. interest rates and a S$30 rebate. |

| DBS Home Loan Customer | 2.88% p.a. interest rates |

| Apply for Green Renovation Loan | 3.68% p.a. interest rates |

To qualify for the most basic Green Renovation Loan, you would need to fulfil any 3 items which include using certified low-VOC paints, energy-efficient lightings, and ceiling fans instead of air-conditioners. For the full checklist, please refer to the website link provided in the table above.

Do note that this promotion will end on 30 June 2021.

6. HSBC Personal Line of Credit Balance Transfer

| Type of Information | Details |

| Website | https://www.hsbc.com.sg/loans/choose-your-loan/#flexible-repayments |

| Contact | +65 6472 2669 |

| Highlights to Note | – 6 months repayment package: 0% p.a. interest rates – 12 months repayment package: S$0 processing fee |

HSBC Personal Line of Credit Balance Transfer allows you to finance your personal goals via the attractive interest rates as shown below:

Repayment Period | 6 months | 12 months |

For Amount | 0% p.a. with processing fee of 2.50% (EIR 5.47% p.a.) | 4.88% p.a. with no processing fee (EIR 4.88% p.a.) |

For Amount ≥SGD10,000 | 0% p.a. with processing fee of 1.50% (EIR 3.26% p.a.) | 4.88% p.a. with no processing fee (EIR 4.88% p.a.) |

HSBC Personal Line of Credit Balance Transfer is more flexible as it allows you to choose between 6 months or 12 months repayment period. The benefit of 6 months repayment period is the 0% interest rates, whereas the benefit of 12 month repayment period is the S$0 processing fees. If you are more concerned about long-term charges, then you can opt for the 6-months repayment package.

7. Citi Quick Cash

| Type of Information | Details |

| Website | https://www.citibank.com.sg/loans/quick-cash.htm?icid=SGCFAK2ENLOMMHEIL |

| Contact | +65 6225 5225 |

| Operation Hours | Daily 8 am to 8 pm |

| Highlights to Note | – Enjoy up to S$400 GrabFood Voucher when you apply for a Personal Loan before 31 May 2021 – Able to apply for a loan through Citi Mobile App – Repay loan with plans of up to 60 months – Unutilized credit limit can be converted to cash |

Citi Quick Cash is currently running a promotion. You can get to enjoy up to S$400 GrabFood Voucher when you apply for a Personal Loan before 31 May 2021. The value of the voucher is based on the loan size, as shown below:

| Loan size/amount | Loans booked via Citi Mobile® App |

| Minimum cumulative amount of S$10,000 | $50 GrabFood Voucher |

| Minimum cumulative amount of S$20,000 | $150 GrabFood Voucher |

| Minimum cumulative amount of S$50,000 | $400 GrabFood Voucher |

One service that Citibank stands out from competitors is the ability to apply for a loan through the Citi Mobile App, which provides added convenience. You can also choose to repay your loans with plans of up to 60 months. If you have an unutilized credit limit, you can even convert them to cash!

The table below shows the personal loan interest rates and fees:

For new to Citi customers taking a minimum loan amount of $20,000

Tenure (months) | 12 | 24 | 36 | 48 | 60 |

Nominal Interest Rates (per annum) | 0.00% | 4.00% | 3.99% | 4.01% | 4.05% |

Processing Fee (%) | 3.50% | 0.00% | 0.00% | 0.00% | 0.00% |

Effective Interest Rates (per annum) | 7.85% | 7.50% | 7.50% | 7.50% | 7.50% |

For new to Citi customers taking a loan amount of less than $20,000

Tenure (months) | 12 | 24 | 36 | 48 | 60 |

Nominal Interest Rates (per annum) | 0.00% | 4.82% | 4.55% | 5.72% | 5.79% |

Processing Fee (%) | 3.50% | 0.00% | 0.00% | 0.00% | 0.00% |

Effective Interest Rates (per annum) | 7.85% | 9.00% | 8.50% | 10.50% | 10.50% |

8. Friday Finance

| Type of Information | Details |

| Website | https://www.fridayfinance.sg |

| Contact | Tel: +65 6303 0306 +65 8774 9906 Email: [email protected] |

| Operation Hours | Monday – Friday 10 am – 6 pm |

| Highlights to Note | – Licensed moneylenders regulated by the Registry of Moneylenders of the Ministry of Law in Singapore – Apply for loans with MyInfo – Will refund 50% of the administrative fees when your loan is fully repaid on time – Monthly interest rate starts from 1% – Administrative fee starts from 2% – Online calculator allows you to key in your loan amount, preferred loan term, and preferred interest rates to project estimated monthly repayment amount |

Friday Finance is a licensed moneylender regulated by the Registry of Moneylenders of the Ministry of Law in Singapore. Friday Finance allows you to apply for loans with MyInfo, which provides added convenience and security.

Friday Finance stands out from commercial banks as they would refund 50% of the administrative fees when your loan is fully repaid on time, allowing you to save more.

The monthly interest rate starts from 1% and the administrative fee starts from 2%.

With its online calculator, you can key in your loan amount, preferred loan term, and preferred interest rates to project estimated monthly repayment amount.

9. State Bank of India Personal Loans

| Type of Information | Details |

| Website | https://sg.statebank/loans |

| Contact | 1800 724 7464 |

| Operation Hours | Monday to Friday 9.30 am – 5.45 pm Saturday 9.30 am – 12.30 pm |

| Highlights to Note | – Loan amount of minimum SGD5,000 and maximum SGD100,000 – Term Loan Package: Monthly Repayment is fixed (Principal +Interest) – Overdraft Package: Monthly Repayment may vary on the amount utilized (Fixed Principal repayment + Interest on the amount utilized) – Choose between loan tenures of 1, 2, 3, 4, and 5 years – Application can be initiated online but required to visit branches after approval of the loan – Debit card with a MasterCard facility is provided upon request – Cheque Book facility is optional |

State Bank of India Personal Loans requires you to take a minimum loan of SGD5,000 and a maximum of SGD100,000. You can choose between Term Loan or Overdraft, as per the description below:

- Term Loan – Monthly Repayment is fixed (Principal +Interest)

- Overdraft – Monthly Repayment may vary on the amount utilized (Fixed Principal repayment + Interest on the amount utilized)

Interest Rate Packages for Term Loan

Tenure (Years) | 1 | 2 | 3 | 4 | 5 |

Nominal Interest Rates (per annum) | 4.66% | 4.55% | 4.27% | 5.44% | 5.79% |

Effective Interest Rates (per annum)^ | 8.50% | 8.50% | 8.00% | 10.00% | 10.50% |

Interest Rate Packages for Overdraft

Tenure (Years) | 1 | 2 | 3 | 4 | 5 |

Effective Interest Rates (per annum)^ | 10.50% | 10.50% | 10.00% | 12.00% | 12.50% |

State Bank of India Personal Loans allows you to choose between loan tenures of 1, 2, 3, 4, and 5 years. The application can be initiated online but you are required to visit any of their branches after approval of the loan. Debit card with MasterCard facility is provided upon request and cheque Book facility is optional.

Conclusion

Do you have any reviews and comments to share regarding our choices for the best renovation loans in Singapore?

While SBO is committed to supporting our local businesses, we welcome any feedback and anonymous sharing regarding your experience with the listed agencies for renovation loans in Singapore.

We hope that this guide will be useful in helping you to make an informed decision when it comes to finding the best renovation loans in Singapore.

Explore More Content

Table of Content