8 Best Personal Loans in Singapore with Low Interest Rates & Fast Approval [2025]

In urgent need of money? Check out the 10 best personal loans in Singapore.

Personal loans, once associated with financial irresponsibility or gambling, have shed that stigma in today’s context. Now seen as a valuable financial tool, they offer support for various life events. Whether it’s funding a wedding, home renovation, medical emergencies, or the arrival of a newborn, personal loans provide essential flexibility. In modern Singapore, they have become an integral part of financial planning for many.

This article will guide you through the top 10 personal loans available, focusing on low-interest rates and fast approval, to help you find the best option for your unique needs.

Key Factors to Consider When Choosing a Personal Loan

| Interest Rates (How much is the cost of taking the loan) | Interest rates are a critical consideration, and it’s essential to understand the concept of Effective Interest Rates (EIR). Nominal Interest Rates for personal loans usually ranges from 3.88% to 6%. While the nominal interest rate may appear low, the EIR includes all fees and compounding effects, providing a more accurate representation of the total cost of borrowing. Comparing EIRs across different loan offers helps you find a rate that truly fits within your budget |

| Approval Requirements (Is it easy to get the loan? How much loan can you get approved for?) | Lenders have varying criteria for loan approval. Some banks may be more stringent, requiring higher credit scores and income levels, while others might be more flexible. Knowing the specific requirements of each lender helps you choose a loan that aligns with your financial profile, thereby increasing your chances of approval. |

| Other Fees (Are there any other charges you need to take note of?) | Besides interest rates, be mindful of other charges like annual fees and processing fees. These additional costs can accumulate, so understanding the full picture of a loan’s cost is vital. |

| Repayment Tenure (Do you want to pay more interests for lower monthly repayment over a longer period of time?) | The repayment period or tenure of the loan affects both the monthly installment and total interest paid. Repayment tenures can vary, with most banks extending up to 5 years. HSBC offers personal loan with repayment tenure up to 7 years. A shorter tenure means higher monthly payments but less interest overall, while a longer tenure results in lower monthly payments but more interest over time. |

![8 Best Personal Loans in Singapore with Low Interest Rates & Fast Approval [[year]] 1](https://sbo.sg/wp-content/uploads/2021/06/mascoutblock.png)

Don’t be mislead by the advertised interest rates!

While banks often advertise their personal loans using the lowest possible interest rates, it’s important to be aware that the actual quoted rate may vary based on your individual credit score and financial history. Always review the specific terms and consult with a financial advisor if needed, to ensure you understand the true cost of the loan for your unique situation.

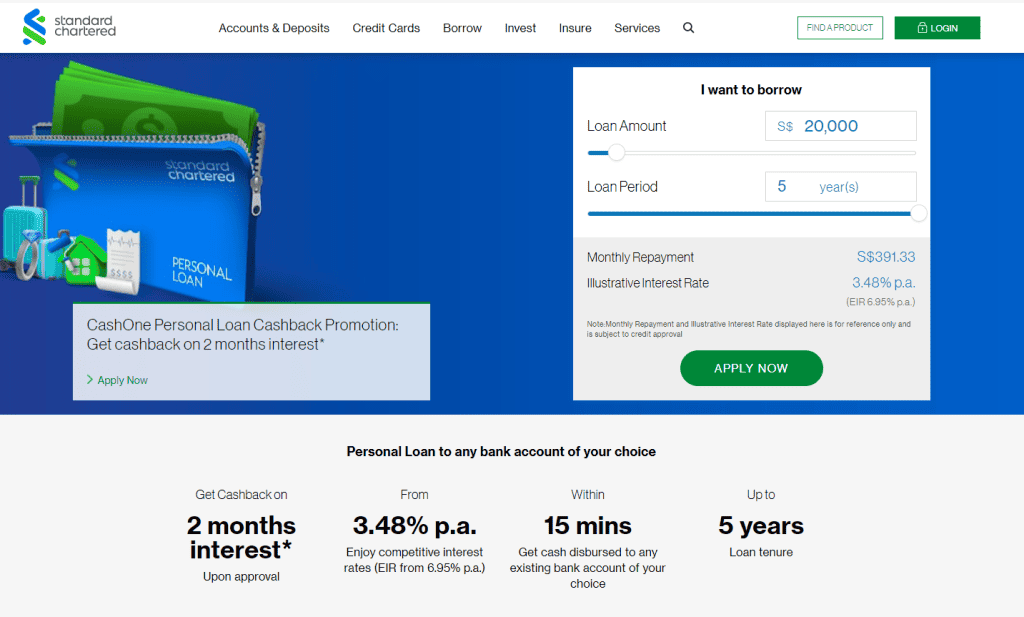

1. Standard Chartered

Standard Chartered stands out as one of the top banks for obtaining a personal loan in Singapore, especially for salaried employees. If you’re a Singaporean, the application process is streamlined through the use of your Singpass (they assess your CPF contributions) , and funds are typically made available within a working day. While the interest rate might be somewhat higher compared to other banks, the convenience and speed of the process make it an attractive option.

| Apply at | https://www.sc.com/sg/borrow/loans/cashone/ |

| Personal loan highlights | – Get 2 months interest worth of cashback – Enjoy competitive flat interest rates from 3.48% p.a. – Get cash disbursed to any existing bank account of your choice within 15 mins – Up to 5 years Loan tenure |

2. HSBC

If you’re considering a personal loan in Singapore, HSBC might be an appealing option. To begin the process, you’ll need to open a personal line of credit account. Known for its accessibility, HSBC offers flexible repayment tenures, extending up to 7 years. This option allows for lower monthly payments, though it may result in paying more interest over the years. It’s worth noting that HSBC’s application process is somewhat manual, and the processing time typically ranges from 2 to 3 weeks.

| Apply At | https://www.hsbc.com.sg/loans/products/personal-line-of-credit/instalment-plan/ |

| Personal loan highlights | – Fixed monthly repayments with choice of tenor between 1 and 7 years. – Flat Interest Rate from 4% p.a – Processing & Annual Fee |

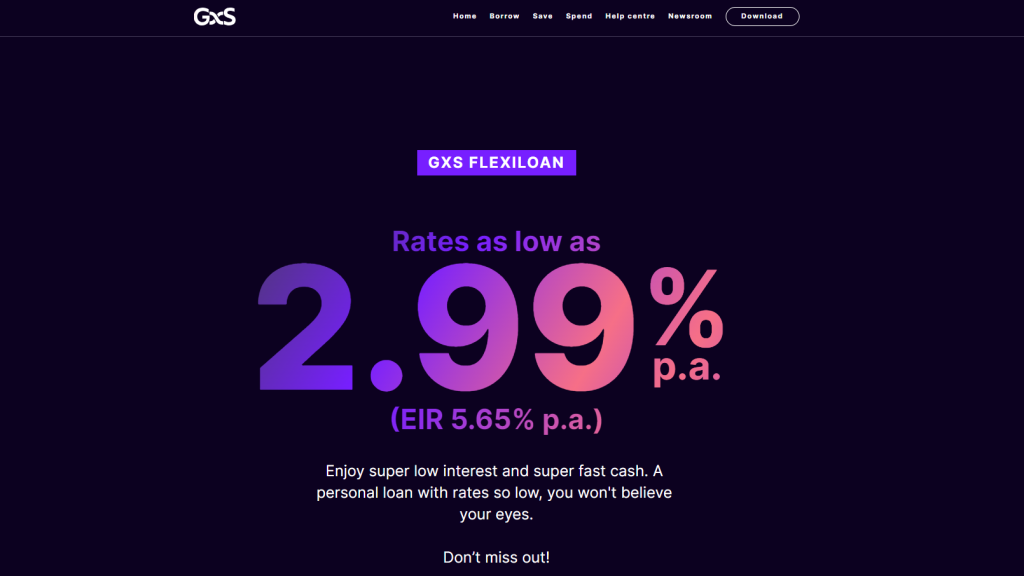

3. GXS

GXS Bank is a digital banking player that offers a variety of financial services tailored for the modern user. One of their flagship products is the GXS FlexiLoan, a personal loan that prioritizes the needs of the borrower. Introduced in August 2023, this loan offers an array of benefits, including flexible repayments, low interest rates, and rapid cash disbursement. One unique feature of GXS FlexiLoan is its no-fee policy – there are no annual, processing, early repayment, or late fees, although late interest is applied for late repayments. The loan is accessible to new FlexiLoan account holders who meet specific eligibility criteria, making it an attractive option for those seeking personal financing solutions

| Apply At | https://www.gxs.com.sg/flexiloan |

| Personal loan highlights | – No annual fee – Flat Interest Rate from 2.99% p.a – Ideal for young savvy customers |

4. UOB

| Apply At | https://www.uob.com.sg/personal/borrow/personal-financing/personal-loan.page |

| Personal loan highlights | – More stringent in their approval process – Flat Interest Rate from 3.77% p.a – Processing & Annual Fee |

UOB Personal Loan provides an attractive interest rate of 3.77% per annum (with an Effective Interest Rate starting from 6.89% per annum).

The loan amount can be a combination of both Credit Card Personal Loan and CashPlus Personal Loan applications. You can choose a loan tenure that fits your needs, with options for 36, 48, or 60 months.

When applying for this personal loan with UOB, you’ll receive a decision on approval or rejection within just 15 minutes.

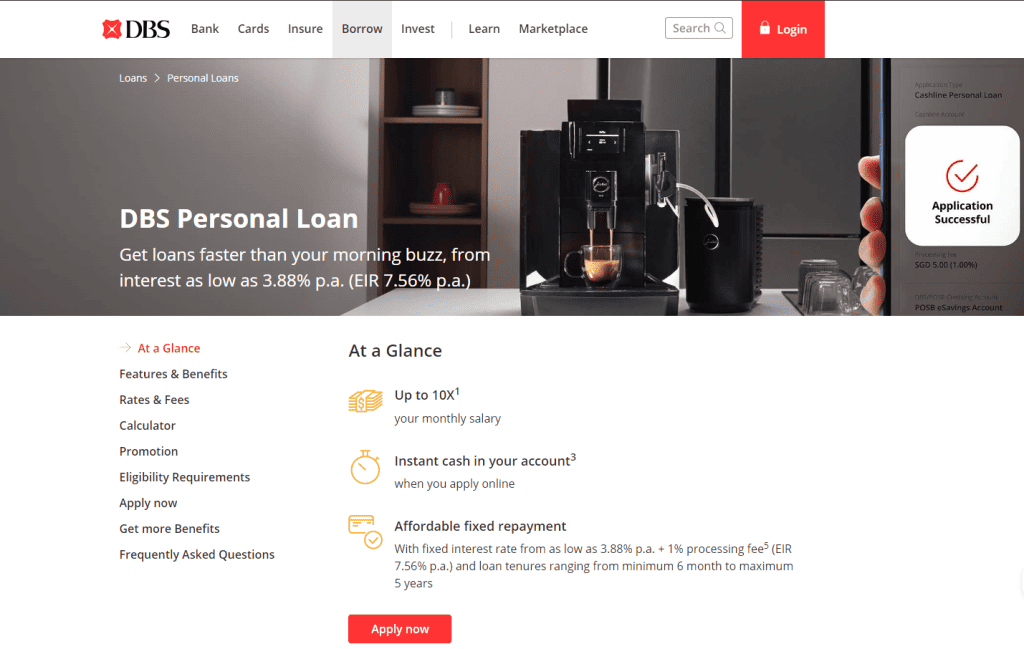

5. DBS

Salary-Based Loan Amounts: Borrowers can receive cash up to 4 times their monthly salary. For those with an annual income of S$120,000 and above, the amount available is increased to 10 times the monthly salary.

Instant Cash Availability: Existing Cashline or Credit Card customers, as well as new customers who currently credit their salary into a DBS/POSB deposit account, can enjoy instant approval and immediate cash access in their account.

Flexible and Affordable Repayment: The loan features monthly installment options that range from a minimum of 6 months to a maximum of 5 years. With an Effective Interest Rate (EIR) starting from a minimum of 7.56% per annum, borrowers can enjoy affordable, fixed repayments. There is also an option for GIRO payment arrangements.

| Apply At | https://www.dbs.com.sg/personal/loans/personal-loans/dbs-personalloan |

| Personal loan highlights | – More stringent in their approval process – Flat Interest Rate from 3.88% p.a – Processing & Annual Fee |

6. OCBC

OCBC Bank offers a personal loan product known as the ExtraCash Loan, which provides fixed repayments. The ExtraCash Loan is designed for individuals who require cash quickly, allowing you to borrow up to 6 times your monthly salary if your annual income is $120,000 and above, or up to 4 times if your annual income is between $30,000 and $120,000. The repayment period ranges from 1 to 5 years, providing flexibility based on your financial needs.

One of the key features of OCBC’s ExtraCash Loan is the fixed monthly repayments, which allow you to manage your finances more effectively. There is also a flat interest rate, which means the interest amount you pay each month remains constant throughout the loan tenure. This can provide predictability and stability for borrowers.

It’s important to note that the ExtraCash Loan comes with a processing fee of 1% of the approved loan amount. Additionally, a late payment charge will apply if you fail to make timely repayments

| Apply At | https://www.ocbc.com/personal-banking/loans/extracash-loan-fixed-repayment.page |

| Personal loan highlights | – More stringent in their approval process – Flat Interest Rate from 5.54% p.a – Processing & Annual Fee |

7. CIMB

The CIMB Cashlite personal loan, also known as the Cashlite personal financing scheme, offers some of the most competitive rates in Singapore, with interest rates as low as 3.5% p.a. for new-to-CIMB bank applicants [2]. This loan is designed to provide swift cash disbursement, making it an ideal choice for those who need funds promptly.

Moreover, the Cashlite personal loan offers a flexible loan tenure, allowing borrowers to choose a repayment period that suits their financial situation. However, it’s important to note that only up to 90% of the borrower’s credit card limit can be borrowed.

One of the most unique selling points of this loan is that it does not have any processing fees, which makes it more cost-effective compared to many other personal loans. However, foreigners and those holding supplementary CIMB bank credit cards are not eligible for this loan. As for existing CIMB customers, they may face higher interest rates.

To qualify for the CIMB Cashlite personal loan, potential borrowers must be at least 21 years old, a citizen or permanent resident of Singapore, and have a minimum annual income of SGD 30,000.

| Apply At | https://www.cimb.com.sg/en/personal/banking-with-us/loans-financing/personal-loans-financing/cimb-cashlite.html |

| Personal loan highlights | – More stringent in their approval process – Flat Interest Rate from 3.34% p.a for new customers – Processing & Annual Fee |

8. Maybank2u

Maybank CreditAble Term Loan offers a flexible personal loan option designed to cater to various financial needs. With the option to choose from repayment periods of 12, 24, 36, 48, or 60 months, the loan offers a competitive interest rate of 3.88% p.a. and a waived processing fee for online applications. The loan is available to existing CreditAble account holders who are Singapore Citizens or Permanent Residents, aged between 21 to 65, with an annual income of at least S$30,000. Online exclusive offers and tools such as a loan repayment calculator are also available, making it convenient for applicants to make an informed decision.

| Apply At | https://www.maybank2u.com.sg/en/personal/loans/personal-line-or-credit/creditable-term-loan.page |

| Personal loan highlights | – Flat Interest Rate from 3.88% p.a for new customers – Processing & Annual Fee |

Exercise Discretion When Getting Personal Loans

Personal loans can be a valuable financial tool, providing a lifeline in situations that require a significant outlay of cash. Whether it’s a life milestone like a wedding or an unexpected emergency, a personal loan can offer the flexibility and support needed to tide over these circumstances.

However, the decision to take out a personal loan should never be made lightly. It’s essential to exercise prudence by thoroughly assessing not only your current earnings but also your potential earning capacity over the next few years. By carefully considering interest rates, approval requirements, fees, and repayment tenure, you can select a loan that aligns with your financial situation and long-term goals.

In doing so, a personal loan can become a strategic and responsible part of your financial planning, rather than a burden.

FAQs about Taking Up Personal Loans in Singapore

Do all banks have the same approval requirements for personal loans?

No, approval requirements can vary significantly between banks. Some may be more stringent with higher credit score and income level requirements, while others may be more flexible. Researching and understanding each bank’s specific requirements can increase your chances of approval.

What is the difference between Personal Loans & other types of loans?

Personal Loans:

Purpose: Personal loans are typically unsecured and can be used for almost any purpose, such as consolidating debt, funding a wedding, home renovations, or emergency expenses.

Interest Rates: They often have fixed interest rates, and the Effective Interest Rate (EIR) gives a clear picture of the overall cost.

Repayment Terms: Personal loans usually have fixed repayment terms that can range from short to medium-term, like one to seven years.

Approval Criteria: The approval is often based on credit score, income, and financial history, without the need to provide collateral.

Other Loans (such as Mortgages, Auto Loans, Student Loans):

Purpose: These are usually secured loans, tied to a specific purpose like buying a home (mortgage), a car (auto loan), or funding education (student loan).

Interest Rates: Interest rates might be fixed or variable, depending on the type of loan and terms offered by the lender.

Repayment Terms: These loans often have longer repayment terms, especially in the case of mortgages, which can extend up to 30 years.

Approval Criteria: Approval for these loans is typically tied to both the borrower’s financial standing and the value of the collateral (e.g., the house or car being purchased).

How much money can a person loan in Singapore?

The amount of money a person can borrow through a personal loan in Singapore depends on various factors, including the individual’s income, credit score, the lender’s policies, and the specific type of loan. Here’s a general overview:

For Unsecured Personal Loans: In Singapore, if your annual income is less than SGD 30,000, you may be limited to borrowing up to one time your monthly salary. If your annual income ranges from SGD 30,000 to SGD 120,000, you may be able to borrow up to four times your monthly salary. For those earning more than SGD 120,000 a year, the borrowing limit might be even higher, but it’s generally capped at a total of 12 times your monthly salary across all unsecured credit facilities.

For Secured Personal Loans: These types of loans are secured against collateral (like property or fixed deposits), so the borrowing limits might be higher, depending on the value of the collateral.

Bank Specifics: Individual banks and financial institutions might have their own specific criteria and limitations, and promotional offers might also affect the borrowing amount.

Regulatory Constraints: Monetary Authority of Singapore (MAS) has regulations governing unsecured credit, which also influence the borrowing limits.

Credit Score and Financial History: Your creditworthiness and financial history play significant roles in determining how much you can borrow. A good credit score may allow you to borrow more, while a poor credit score might limit your options.

What can I do if I have a bad credit score?

Understand Your Credit Report: Obtain a copy of your credit report to understand what factors might be affecting your credit score. This understanding will help you address specific issues.

Consider a Secured Loan: If you have assets such as property or fixed deposits, you may be eligible for a secured loan, where the asset serves as collateral. Lenders may be more willing to offer loans with collateral, even if your credit score is low.

Seek a Co-Signer: If you have a family member or friend with a good credit score who is willing to co-sign the loan, this can provide the lender with additional reassurance and may help you secure the loan.

Work with a Credit Counseling Service: Credit counseling agencies can help you understand your credit situation and develop a plan to improve your creditworthiness.

Approach Alternative Lenders: Some licensed moneylenders or specialized financial institutions may offer loans designed for individuals with poor credit. However, these may come with higher interest rates and less favorable terms.

Negotiate with Lenders: Sometimes, having an open and honest conversation with a lender about your financial situation may lead to a tailored solution.

Improve Your Credit Score: Focus on improving your credit score by paying all bills on time, reducing existing debt, and avoiding taking on new credit unnecessarily. While this is a longer-term solution, it is the most effective way to enhance your borrowing capacity in the future.

Avoid Unlicensed Moneylenders: It might be tempting to approach unregulated lenders, but this can lead to serious legal and financial troubles. Always work with licensed and reputable institutions.

Consider Alternatives: If a loan isn’t immediately necessary, consider other financial strategies such as budgeting, saving, or seeking assistance from social services if you are in a crisis.

Explore More Content

Table of Content