7 Best Debt Consolidation Loans in Singapore to Work Towards Your Debt-Free Goal [2025]

Work towards your debt-free goal with the best debt consolidation loans in Singapore.

Life has a funny way of sneaking up on us with unexpected twists and turns. Sometimes, those surprises come in the form of opportunities, but other times, they bring challenges like mounting debts from different sources. If you find yourself juggling multiple credit card bills, loans, and the constant worry that accompanies them, you’re not alone. And, believe it or not, you’re not without options.

Consolidate Your Debts With Financial Institutions or Moneylenders

Licensed Moneylenders: Borrowers can choose to consolidate their debts through licensed moneylenders. These are companies licensed to lend money to individuals and are regulated by local laws and regulations. They may offer debt consolidation loans that allow you to combine various debts into one loan, often with a single monthly payment. It’s essential to research and choose a reputable licensed moneylender, as terms and interest rates can vary widely.

Financial Institutions (FIs) through the Debt Consolidation Plan (DCP) Route: The Debt Consolidation Plan is a specific financial product offered by various financial institutions. It’s designed to help individuals consolidate all of their unsecured credit (such as credit card balances and personal loans) into a single loan. DCP generally offers the advantage of potentially lower interest rates and a more structured repayment plan. By going through the DCP route, borrowers can simplify their debt management and may obtain more favorable repayment terms.

The table below highlights the differences between consolidating your debts with licensed moneylenders as opposed to financial institutions:

Financial Institutions | Licensed Moneylenders | |

|---|---|---|

Pros: |

|

|

Cons: |

|

|

![7 Best Debt Consolidation Loans in Singapore to Work Towards Your Debt-Free Goal [[year]] 1](https://sbo.sg/wp-content/uploads/2021/06/mascoutblock.png)

Important Thing to Note about Debt Consolidation

If you choose to obtain a debt consolidation plan from an official financial institution, you will lose all your other credit facilities. You can only have a credit card with limit equal to 1x your monthly income for daily expenses. If you wish to avoid this, you may want to consider consolidating your loans with licensed moneylenders instead.

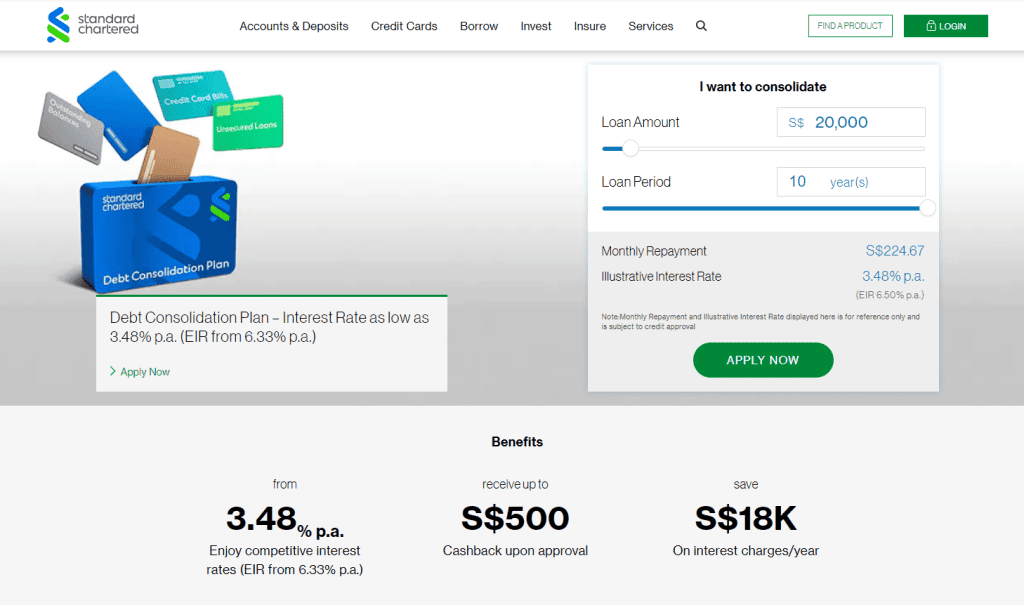

1. Standard Chartered Debt Consolidation Plan

| Website | https://www.sc.com/sg/borrow/loans/debt-consolidation/ |

| Features & Benefits | – Cashback depending on seasonal promotions – 3.48% per annum and enjoy competitive rates |

| Eligibility | Annual income: Between S$30,000 and below S$120,000 Unsecured outstanding balances: More than 12 times of monthly income Age: 21 – 65 years |

The Standard Chartered Debt Consolidation Plan is a financial solution designed to help individuals consolidate their outstanding balances across multiple banks into a single loan. This program offers competitive interest rates starting from 3.48% per annum and an Effective Interest Rate from 6.33% per annum. By opting for this loan, borrowers can save up to SGD 14,000 on refinanced debt interest charges and receive a 6% cashback. Alongside the loan, customers are issued a Platinum Mastercard Credit Card, with its credit limit determined by the borrower’s monthly income. Remember, various terms and conditions apply, and the actual loan amount, tenure, cashback and interest rates may vary based on the borrower’s credit profile

2. OCBC Debt Consolidation Plan

| Website | https://www.ocbc.com/personal-banking/loans/debt-consolidation.page |

| Features & Benefits | – Repayment period of 36 to 96 months – Fixed repayment amount – Complimentary credit card |

| Eligibility | Age and Annual income: Singaporean or Singapore PR above 21 years old with an annual income between S$30,000 and S$120,000 BTI: Those with Balance-to-Income (BTI) of at least 12x their monthly income |

The OCBC Debt Consolidation Loan is a financial solution designed to help individuals combine multiple debts into one manageable loan. Here’s a detailed description of the features offered by OCBC for debt consolidation:

- Repayment period of 36 to 96 months: This allows customers to choose a repayment plan that best suits their needs, providing flexibility over a period of 3 to 8 years.

- Fixed repayment amount: Unlike variable interest rates, OCBC offers fixed monthly installments that help borrowers manage their repayment with ease. Payments can be made through various convenient methods like Online or Mobile Banking funds transfer, cheque deposit, or cash deposit machine.

- Save on interest charges: The debt consolidation loan is charged at a lower interest rate compared to the prevailing interest rates of credit card and overdraft facilities, providing substantial savings over time.

- Complimentary credit card: As an added benefit, OCBC provides a complimentary Debt Consolidation Card (OCBC Platinum Credit Card) for everyday expenses. It offers a credit limit of 1x your monthly income and doesn’t charge annual fees. However, it’s essential to note that the Debt Consolidation Card is subject to the prevailing credit card interest rate of 26.88% per annum, along with other fees and charges, and compounding applies if charges are not repaid in full.

3. HL Bank Debt Consolidation Plan

| Website | https://www.hlbank.com.sg/en/personal-banking/loans/personal-loan/debt-consolidation-plan.html |

| Features & Benefits | – Reduce your total monthly payments substantially by stretching your loan repayments by up to 10 years – Total outstanding debt of more than 12 times your monthly income. An annual income of at least S$30,000 but below S$120,000 |

| Eligibility | Age: Between 25 and 65 years old Citizenship: A Singapore citizen or Singapore permanent resident Annual income: Earning an annual income between S$30,000 and below S$120,000 with net personal assets of less than S$2million Debt: Having a total interest-bearing unsecured debt on all credit cards and unsecured credit facilities with financial institutions in Singapore that exceeds 12 times your monthly income |

HL Bank’s Debt Consolidation Loan is a tailored financial product designed to help individuals manage their multiple debts efficiently. Here’s an overview of the features and requirements of this offering:

- Interest Rates: HL Bank offers competitive interest rates for this product, starting as low as 3.8% per annum, with Effective Interest Rates (EIR) beginning from 6.78% per annum.

- Extended Repayment Period: One of the key features of this loan is the ability to stretch payments up to 10 years. This extended period can help reduce total monthly payments substantially, making the repayment process more manageable.

- Eligibility Requirements:

- Total Outstanding Debt: Applicants must have a total outstanding debt of more than 12 times their monthly income.

- Annual Income Requirements: To qualify, individuals must have an annual income of at least S$30,000 but below S$120,000.

- Convenience of Consolidation: This loan allows borrowers to consolidate all outstanding debts from credit cards, lines of credit, personal loans across different financial institutions, or even refinance an existing Debt Consolidation Plan. This unification into a single loan under HL Bank makes tracking and repaying the debt much more straightforward.

- Revolving Credit Facility: HL Bank also offers a revolving credit facility with a limit of up to one time the borrower’s monthly income. This survival credit can act as a financial cushion for everyday expenses.

4. Citibank Debt Consolidation Plan

| Website | https://www.citibank.com.sg/gcb/loans/debt-consolidation/debt-consolidation.htm |

| Features & Benefits | – Loan tenure of up to 7 years – A credit card with a limit of 1X your monthly income – Lower monthly repayments |

| Eligibility | Annual income: Singaporeans & PRs Annual income between S$30,000 – S$120,000 Age: 21 years old & above |

Citibank’s Debt Consolidation Plan (DCP) is designed to simplify debt management, providing a structured solution to individuals who find themselves juggling multiple debts. Here’s a detailed look at what the plan offers:

- Single Bank Repayment Convenience: Citibank’s DCP allows you to consolidate various debts into one loan, making repayments to just one bank. This convenience eases the tracking and management of your debts.

- Flexible Loan Tenure: With this plan, borrowers have the option to choose a loan tenure of up to 7 years. This flexibility enables them to select a repayment schedule that fits their individual financial situation.

- Credit Card Provision: As part of the plan, Citibank provides a credit card with a limit equal to 1X your monthly income. This serves as a useful tool for managing everyday expenses.

- Lower Monthly Repayments: By consolidating debts and stretching the repayment period, Citibank’s DCP can lead to lower monthly repayments. This feature is aimed at easing the financial burden on the borrower.

5. HSBC Debt Consolidation Plan

| Website | https://www.hsbc.com.sg/loans/products/debt-consolidation/ |

| Features & Benefits | – Single repayment through consolidation bank account – Stretch your monthly repayments for up to 10 years – Interest rates from as low as 3.4% p.a. (EIR: 6.5% p.a.) – Complimentary HSBC Visa Platinum credit card – Free Credit Bureau Report |

| Eligibility | Nationality: Singaporean or Singapore Permanent Resident (PR) Annual income: Between SGD30,000 and SGD119,999 for salaried or between SGD40,000 and SGD119,999 for the self-employed or commission-based earner |

HSBC’s Debt Consolidation Loan offers an innovative approach to managing multiple debts by consolidating them into a single repayment structure. Aimed at making debt management more streamlined and affordable, the loan comes with several features and benefits that cater to various financial needs:

- Single Repayment Through Consolidation Bank Account: HSBC simplifies the repayment process by consolidating various outstanding loans and credit card balances into one bank account. This unified approach helps in reducing the complexity of managing multiple payments.

- Extended Repayment Period: The plan allows borrowers to stretch their monthly repayments for up to 10 years. This extended tenure can lead to more manageable monthly payments and provide financial flexibility.

- Competitive Interest Rates: Offering interest rates as low as 3.4% per annum (with an Effective Interest Rate of 6.5% p.a.), HSBC’s Debt Consolidation Loan is structured to be an affordable option for those looking to consolidate their debts.

- Complimentary HSBC Visa Platinum Credit Card: As part of the Debt Consolidation Loan, HSBC provides a complimentary Visa Platinum credit card. This addition offers further convenience in managing everyday expenses.

- Free Credit Bureau Report: For a limited time, applicants can get a free credit report, providing detailed insights into their credit standing. This report can be an essential tool for those looking to understand their financial health and plan accordingly.

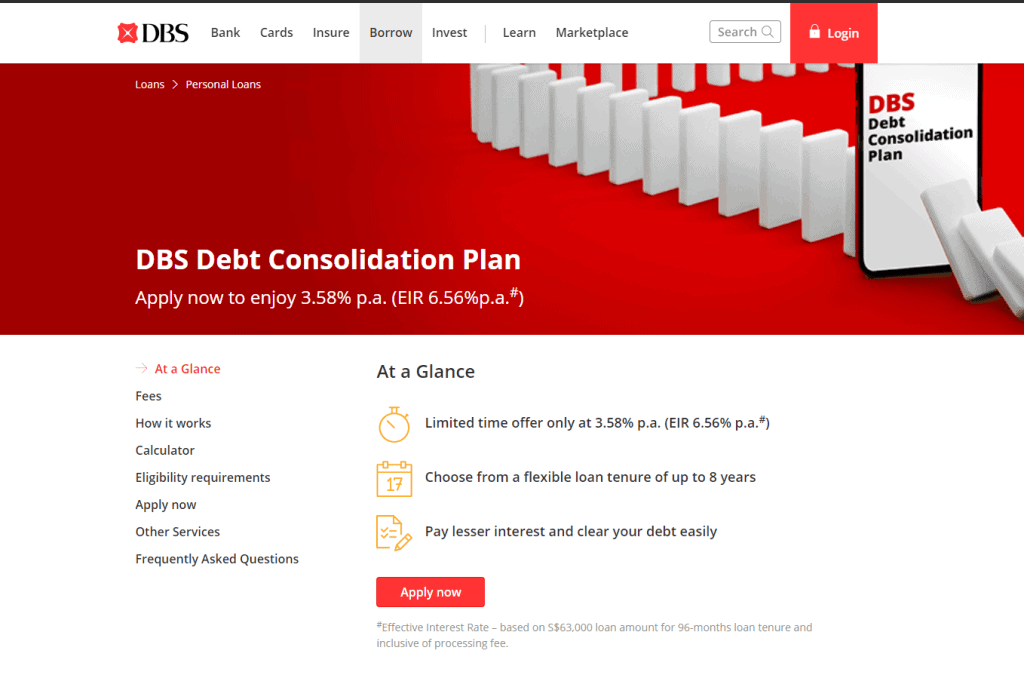

6. DBS Debt Consolidation Plan

| Website | https://www.dbs.com.sg/personal/loans/personal-loans/dbs-debt-consolidation-plan |

| Features & Benefits | – Single repayment through consolidation bank account – Stretch your monthly repayments for up to 8 years – Interest rates from as low as 3.58% p.a. (EIR: 6.5% p.a.) – Complimentary HSBC Visa Platinum credit card – Free Credit Bureau Report |

| Eligibility | Nationality: Singaporean or Singapore Permanent Resident (PR) Annual income: Between SGD30,000 and SGD119,999 for salaried or between SGD40,000 and SGD119,999 for the self-employed or commission-based earner |

DBS offers a Debt Consolidation Plan that helps borrowers manage multiple debts by consolidating them into one single repayment. With the promise to pay lesser interest and clear your debt easily, the plan is tailored to offer flexibility and convenience. Below are the features, benefits, fees, and eligibility requirements:

- Limited Time Interest Rate: A special rate of 3.58% p.a. (Effective Interest Rate of 6.56% p.a.) is being offered for a limited time. This rate is based on a loan amount of S$63,000 for a 96-month loan tenure and includes a processing fee.

- Flexible Loan Tenure: Choose from a loan tenure of up to 8 years, giving you the flexibility to find the right fit for your financial situation.

- Complimentary DBS Visa Platinum Credit Card: This plan comes with a DBS Visa Platinum Credit Card with a maximum credit limit of 1x your monthly income, and no annual fee, providing a convenient way to manage daily essentials.

7. Credit Hub Capital

| Website | https://credithubcapital.sg/debt-consolidation-loan-singapore/ |

| Features & Benefits | – No maximum or minimum amount of loan – Maximum loan approval turnover time is 60 minutes |

| Eligibility | Age: At least 21 years old Employment: Have details of your CPF contribution or your income tax notice for the last 12 months |

For those worried about the potential impact on their credit history that debt consolidation may have, considering other avenues for financial assistance may be wise. One such alternative is seeking funds from licensed moneylenders like CreditHub Capital. Unlike traditional financial institutions, licensed moneylenders may provide more flexible terms and may not always require stringent credit checks. This can be an attractive option for those who want to maintain their current credit status but still need access to funds.

CreditHub Capital, as a licensed moneylender, might offer personalized loan options to suit individual needs without necessarily affecting one’s credit history. By thoroughly reviewing the terms and conditions and working closely with the lender, borrowers can identify the right financial solution that aligns with their situation.

FAQs for Debt Consolidation Loans / Plan

What is a Debt Consolidation Plan, and How Does It Work?

A Debt Consolidation Plan is a refinancing program designed to assist those burdened by unsecured credit facilities like credit cards and some unsecured loans.

Under DCP, all unsecured debts across various financial institutions can be consolidated into a single financial institution, simplifying payment and potentially reducing interest costs.

However, certain categories, such as joint accounts, renovation loans, education loans, medical loans, and credit facilities for businesses, are excluded from DCP.

Who Qualifies for a Debt Consolidation Plan in Singapore?

To qualify for a debt consolidation plan in Singapore, an individual must meet specific criteria:

Citizenship/Residency: The applicant must be a Singapore Citizen or Permanent Resident.

Income Requirements: The applicant’s annual income must be between S$20,000 and below S$120,000. This income criteria is subject to individual assessments by the participating financial institutions (FIs), as the DCP is a commercial product.

Net Personal Assets: The applicant must have Net Personal Assets of less than $2 million. This refers to the total value of an individual’s assets minus their liabilities, and the assets must be substantiated with supporting documents.

Unsecured Debt Level: The applicant’s total interest-bearing unsecured debt on all credit cards and unsecured credit facilities with financial institutions in Singapore must exceed 12 times their monthly income. This includes various credit facilities but excludes specific categories like joint accounts, renovation loans, education loans, medical loans, and credit facilities granted for business purposes.

Participating Financial Institutions: The DCP can only be consolidated with one of the 15 participating financial institutions, such as American Express International, Citibank Singapore Limited, DBS Bank Ltd, HSBC Bank (Singapore), and others. This list is subject to revision, and new institutions may be added or substituted.

Can a Debt Consolidation Plan Impact My Credit Score?

Debt Consolidation Plan can influence your credit score and stay on your Credit Bureau report for 3 years after closure. Additionally, it requires a careful examination of the terms, conditions, fees, and potential prepayment penalties. Refinancing options are available, subject to terms.

What are the Potential Risks and Benefits of Debt Consolidation Loans?

Benefits include simplifying monthly payments, potentially lowering interest rates, and improving financial management. Risks may include potential fees, the temptation to accumulate more debt, and the possibility that you may pay more over time if the loan’s term is significantly extended. It’s essential to carefully review the terms and consult with a financial professional to understand the specific risks and benefits for your situation.

How Do I Choose the Best Debt Consolidation Loan in Singapore?

Choosing the best debt consolidation loan requires careful consideration of interest rates, fees, loan terms, and customer service. Comparing different offerings, reading reviews, understanding your financial needs, and possibly consulting with a financial advisor can help you select the option that aligns best with your goals and circumstances.

Explore More Content

Table of Content