10 Best Rewards Credit Card in Singapore for Great Perks [2025]

If you use your credit card frequently, you should definitely check out our list of the top 10 best rewards credit card in Singapore that has great perks and benefits!

If you spend frequently with your credit card, you will understand how important it is to have a good rewards credit card. Rewards credit cards will offer you different perks, such as cash back, points or travel miles whenever you spend with the card. These rewards serve as a form of bonus or perks for customers who meet the card’s spending threshold within a set period of time.

There are many different types of rewards credit cards in the market that you can choose from. It is important that you do not get lured into the attractive benefits of each rewards credit card and end up with numerous cards in your wallet. Each type of rewards credit card offers different types of perks, some of which will be more suitable for your needs and preferences. As such, do check out our list of the 10 best rewards credit card in Singapore with great perks.

1. Maybank Family & Friends MasterCard

| Type of Information | Details |

| Website | https://www.maybank2u.com.sg/en/personal/cards/credit/maybank-family-and-friends-mastercard.page |

| Min Requirement | $30,000 |

| Highlights to note | – 3 card designs to choose from – Earn 8% cashback globally – Best Credit Card Initiative 2021 |

| Contact Number | 1800-629 2265 (1800-MAYBANK) |

| Online Reviews | 7 Seedly Reviews (Average ratings: 4.7 / 5.0 stars) |

With Maybank Family & Friends MasterCard, you can get to enjoy up to 8% cash back from various lifestyle categories such as groceries, dining and food delivery, transport, online shipping etc. This will apply when you meet the minimum monthly spend of $800, making it a great fit for you if you spend frequently on lifestyle products.

Maybank is having a promotion currently – Get Garmin vívomove Style worth S$469 with Maybank Credit Cards and CreditAble. All you need to do is to apply for a new Maybank Credit Card and CreditAble, and charge to your Credit Card and/or withdraw from your CreditAble Account a minimum of S$300 for each of the first two consecutive months upon approval. Limited to the first 2,000 approved applicants and exclusive to first-time applicants.

2. Citi Rewards Card

| Type of Information | Details |

| Website | https://www.citibank.com.sg/credit-cards/rewards/citi-rewards-card/ |

| Min Requirement | $30,000 |

| Highlights to note | – Use points to pay for purchases – Redeem and manage your points flexibly – Get deals and discounts locally & in 95 other countries |

| Contact Number | +65 6225 5225 |

| Online Reviews | 36 Seedly Reviews (Average ratings: 4.4 / 5.0 stars) |

With Citi Rewards Card, you can get to earn up to 10x rewards on all online and shopping purchases, and a 1x reward on all other retail spending. Also, transport and food delivery wise, you can earn up to 10x rewards when you take on rides with Grab, Gojek and more, as well as on online food delivery.

Citibank is having a few promotions – You can get up to 22% off* and 10% ZALORA cashback with $100 min. spend. This is valid till 31 January 2022. T&Cs apply. They also have promotion partnerships with other brands such as Island Kitchen Collective and Love, Bonito. So if you are a major fan of these brands, this card will definitely be a great fit for you.

3. HSBC Revolution Credit Card

| Type of Information | Details |

| Website | https://www.hsbc.com.sg/credit-cards/products/revolution/ |

| Min Requirement | $30,000 |

| Highlights to note | – No minimum spend required – Up to 10X Reward points on online purchases and contactless payments |

| Contact Number | 1800-227 6868 |

| Online Reviews | 2 MoneyLobang Reviews (Average ratings: 4.5 / 5.0 stars) |

HSBC Revolution Credit Card is an eco-friendly credit card that is made from 85.5% recycled plastic, indicating their commitment to saving the environment. You can get up to 10X Reward points, which is equivalent to 4 miles or 2.5% cashback for every dollar that you spend.

You can get to redeem exciting gifts and lifestyle experiences with your rewards points, No minimum spending is needed and you can rack up rewards points every time you make an online or contactless payment. There is no annual credit card fee as well. HSBC is having a promotion now where you can be rewarded with up to SGD200 cashback when you spend on your card.

4. DBS Woman’s Card

| Type of Information | Details |

| Website | https://www.dbs.com.sg/personal/cards/credit-cards/dbs-woman-mastercard-card |

| Min Requirement | $30,000 for DBS Woman’s Card $80,000 for DBS Woman’s World Card |

| Highlights to note | – Up to 10X DBS Points (or 20 miles) per S$5 spent – Complimentary e-Commerce Protection for your online purchases |

| Contact Number | +65 6333 0033 |

| Online Reviews | 30 Seedly Reviews (Average ratings: 4.7 / 5.0 stars) |

DBS Woman’s Card allows you to immerse yourself in a world where women get what they want. You can get up to 10X DBS Points (or 20 miles) per S$5 spent on online and overseas purchases. Also, there is complimentary e-Commerce Protection for your online purchases so you need not have to worry about items not delivered or are defective.

With DBS Woman’s Card, you can also get to enjoy multiple women privileges in various categories such as beauty and wellness, dining and entertainment, fashion etc. Also, DBS is having a promotion now where you can get S$200 Great World e-vouchers with promo code DBSGW.

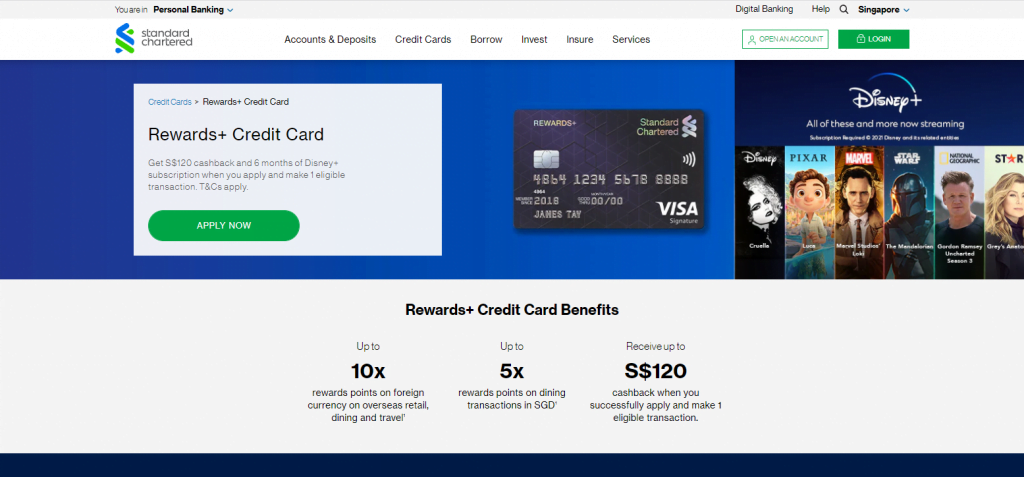

5. Standard Chartered Rewards+ Card

| Type of Information | Details |

| Website | https://www.sc.com/sg/credit-cards/rewards-plus-credit-card/ |

| Min Requirement | $30,000 |

| Highlights to note | – Instant Digital Credit Card – CardSafe Guarantee – Complimentary travel medical insurance |

| Contact Number | +65 6747 7000 |

| Online Reviews | 1 Seedly Review (Average ratings: 5.0 / 5.0 stars) |

Are you an avid traveller? If you are, the Standard Chartered Rewards+ Card is definitely a right fit for you. This is especially so, given the recent VTL scheme where you can finally travel overseas to several countries. With Standard Chartered Rewards+ Card, you can earn up to 10x rewards points on foreign currency on overseas retail, dining and travel.

Local wise, you can also enjoy up to 5x rewards points on dining transactions in SGD, so you do not have to worry about not being able to use your rewards credit card in Singapore. Standard Chartered is having a promotion now – Get S$120 cashback and 6 months of Disney+ subscription when you apply and make 1 eligible transaction. T&Cs apply.

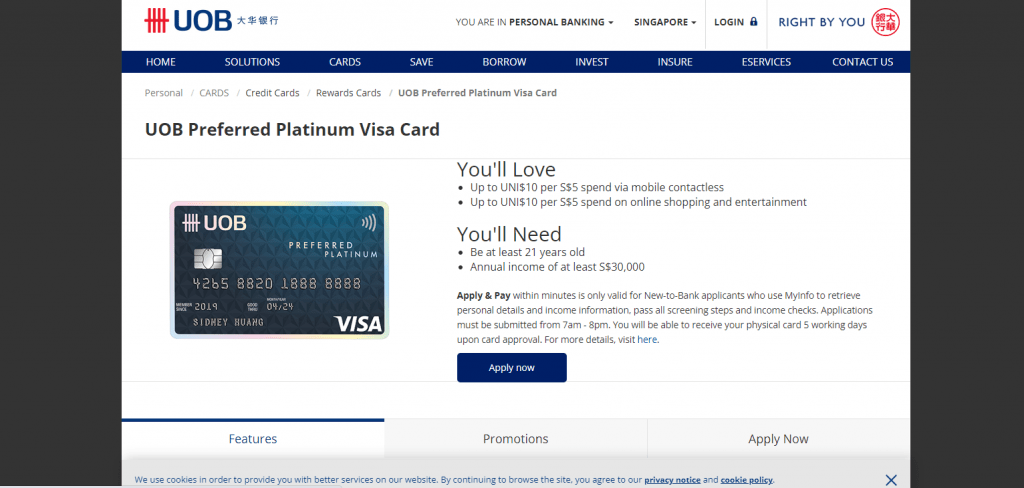

6. UOB Preferred Platinum Card

| Type of Information | Details |

| Website | https://www.uob.com.sg/personal/cards/credit-cards/rewards-cards/uob-preferred-platinum-visa-card.page |

| Min Requirement | $30,000 |

| Highlights to note | – Up to UNI$10 per S$5 spend via mobile contactless – Up to UNI$10 per S$5 spend on online shopping and entertainment – UOB SMART$ Programme |

| Contact Number | 1800 222 2121 |

| Online Reviews | 16 Seedly Reviews (Average ratings: 4.7 / 5.0 stars) |

The UOB Preferred Platinum Visa is part of UOB’s “Preferred Platinum” series, where you can enjoy up to UNI$10 per S$5 spend via mobile contactless, and up to UNI$10 per S$5 spend on online shopping and entertainment. They are a great option for those with a smaller budget, frequently shops alone use digital mobile payment a lot and wish to earn miles rewards.

UOB is having a promotion now – Grab the latest Smartphone with S$1,299 Singtel voucher*, or S$300 cash credit* when you apply. The Singtel vouchers are for the first 35 new-to-UOB Credit Cardmembers to successfully apply for a UOB personal credit card online. The cash credit is for the subsequent 100 new-to-UOB Credit Cardmembers. This promotion ends on 31 October 2021 and requires you to spend a min. of S$1,500 within 30 days from the card approval date.

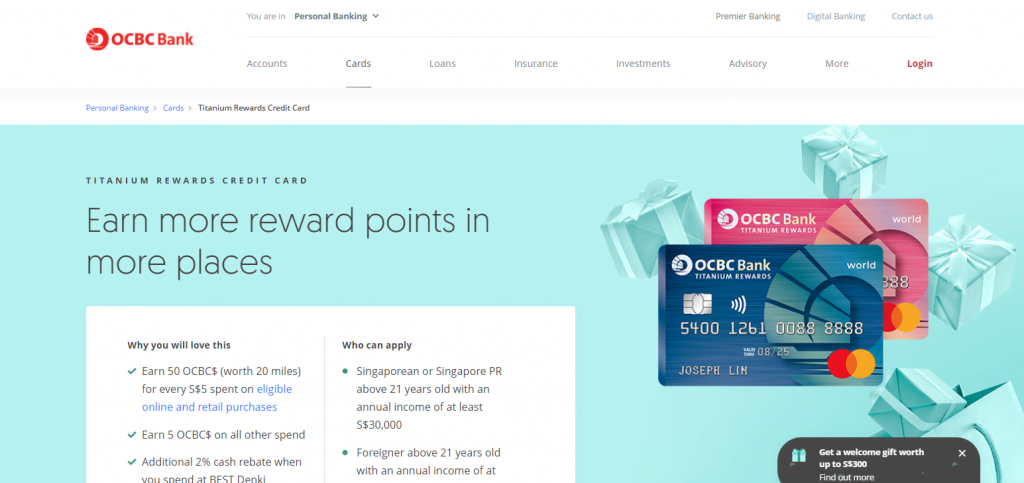

7. OCBC Titanium Card

| Type of Information | Details |

| Website | https://www.ocbc.com/personal-banking/cards/titanium-rewards-credit-card.page |

| Min Requirement | $30,000 |

| Highlights to note | – Earn 50 OCBC$ (worth 20 miles) for every S$5 spent for online and retail purchases – Earn 5 OCBC$ on all other spends – E-Commerce Protection |

| Contact Number | 1800 363 3333 |

| Online Reviews | 6 MoneyLobang Reviews (Average ratings: 4.5 / 5.0 stars) |

OCBC Titanium Card is a rewards credit card that lets you earn rewards wherever you go. Regardless of whether you shop online or in stores, locally or overseas, you will be able to earn up to 50 OCBC$ (worth 20 miles) for every S$5 spent for online and retail purchases. You can also enjoy shopper privileges at multiple stores such as Zalora, Best Denki and many more.

OCBC is having a promotion now – Apply for an OCBC Titanium Rewards Credit Card and receive welcome gift vouchers worth up to S$300 via STACK, their digital loyalty platform.

8. POSB Everyday Card

| Type of Information | Details |

| Website | https://www.posb.com.sg/personal/cards/credit-cards/posb-everyday-card |

| Min Requirement | $30,000 |

| Highlights to note | – Enjoy up to 3% cash rebates on your recurring utilities and telecommunications bills – Earn 0.40% p.a. or more with DBS Multiplier Account |

| Contact Number | 1800 339 6666 |

| Online Reviews | 176 Seedly Reviews (Average ratings: 4.0 / 5.0 stars) |

POSB Everyday Card allows you to enjoy up to 10% cash rebates on dining and online shopping at selected e-Marketplaces, and up to 3% cash rebates on your recurring utilities and telecommunications bills. Not only so, but you can also enjoy cash rebates on other categories such as groceries, travel, transport and fuel and many more.

You can also earn 0.40% p.a. or more with DBS Multiplier Account when you credit your salary & spend on your card, with no minimum amount. POSB is having a promotion now – Get up to 28% cashback with promo code MORECASH.

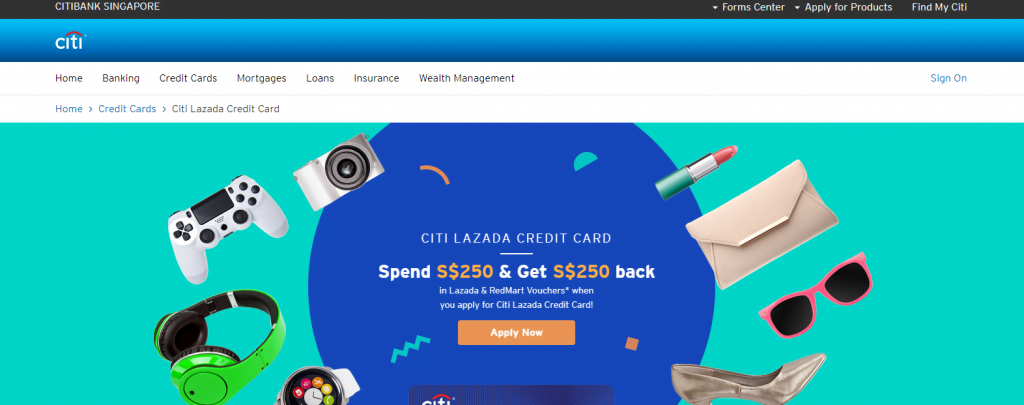

9. Citi Lazada Credit Card

| Type of Information | Details |

| Website | https://www.citibank.com.sg/credit-cards/rewards/lazada-credit-card/ |

| Min Requirement | $30,000 |

| Highlights to note | – Shipping Rebates on Lazada – Earn 10X Rewards^ on Lazada spend – Exclusive Offers on Lazada |

| Contact Number | +65 6225 5225 |

| Online Reviews | 1 MoneyLobang Review (Average ratings: 5.0 / 5.0 stars) |

As the name suggests, Citi Lazada Credit Card is perfect for people who are a major fan of Lazada. You can earn up to 10X Rewards on Lazada spend and enjoy shipping rebates when you spend a min. of S$50 per transaction at Lazada. Not only so, you will also get exclusive offers on Lazada throughout the year.

Apart from the perks you can get from Lazada, you can also enjoy up to 5X Reward Points on your lifestyle categories such as Dining, Travel, Entertainment and Commute. There is also complimentary travel insurance when you charge your airfare to Citi Lazada Credit Card.

Citibank is having a promotion now – Receive a welcome gift of S$250 Lazada & RedMart Vouchers* as you spend. New to Citibank customers only.

10. OCBC Plus! Credit Card

| Type of Information | Details |

| Website | https://www.ocbc.com/personal-banking/cards/plus-rebate-visa-credit-card |

| Min Requirement | $30,000 |

| Highlights to note | – Enjoy savings on daily essentials – Up to 20.3% fuel savings – Get up to a 7% rebate at FairPrice |

| Contact Number | +65 |

| Online Reviews | 30 Seedly Reviews (Average ratings: 4.6 / 5.0 stars) |

OCBC Plus! Credit Card allows you to enjoy savings on daily essentials such as petrol and fuel, groceries, utility bills etc. You can get up to 7% rebate at FairPrice and up to 20.3% of fuel savings at Esso, including a 16% instant discount for all fuel.

Not only so, but you can also get up to 3% off for other spending such as at Cheers and Popular, and a 0.22% LinkPoints rebate on all Visa spendings. For even greater fuel savings, you can link your Esso Smiles Account to your card to transfer your existing Smiles Points.

Conclusion

Do you have any reviews and comments to share regarding our choices for the best rewards credit card in Singapore?

While SBO is committed to supporting our local businesses, we welcome any feedback and anonymous sharing regarding your experience with the listed rewards credit card in Singapore.

We hope that this guide will be useful in helping you to make an informed decision when it comes to finding the best rewards credit card in Singapore.

Explore More Content

Table of Content