10 Best Car Loan in Singapore that You Can Apply Based on Your Needs and Wants [2025]

We know buying a car is a huge financial commitment and so we have put together a list of the 10 best car loan in Singapore to alleviate your finances.

Owning a car in Singapore can be really expensive. In addition to the car that we have to pay for, there are also additional fees from the COE (Certificate of Entitlement), OMV (Open Market Value) and PARF (Preferential Additional Registration Fee), which all adds up to a substantial amount of money.

As such, we want to help car buyers alleviate their financial burden as much as possible. We have compiled a list of the 10 best car loan in Singapore that you can apply, according to your needs and wants.

1. DBS Green Car Loan

| Type of information | Details |

| Website | https://www.dbs.com.sg/personal/promotion/greencar-carloan |

| Highlights to Note | – Enjoy an electrifying rate of 1.68% p.a. – Applies to both new and used green cars – One tree will be planted for every new DBS Green Car Loan application |

| Contact Details | Tel: 1800 111 1111 |

Apart from the OCBC Eco-care Car Loan, customers who are interested in buying a green car can also consider applying for the DBS Green Car Loan. You will also get to enjoy a competitive rate of 1.68% per annum and this loan is eligible for both new and used green cars. A minimum loan of S$10,000 will be required and a minimum loan tenure of 1 year.

In collaboration with NParks OneMillionTrees movement, one tree will be planted for every new DBS Green Car Loan application. So, help the Earth and plant some trees by applying for this loan today!

2. OCBC Eco-Care Car Loan

| Type of information | Details |

| Website | https://www.ocbc.com/personal-banking/loans/car-loans |

| Highlights to Note | – Exclusive package at 1.68% per annum – Up to 12 months of free charging depending on your property type – Exclusive benefits with the purchase of a new Tesla EV |

| Contact Details | Tel: +65 6363 3333 (24-hour) |

This car loan is best suited for those who are looking to purchase an electric car. With a competitive interest rate of 1.68% per annum, OCBC Eco-Care Car Loan has one of the lowest interest rates for car loans in Singapore.

You can enjoy up to 12 months of free charging depending on your property type and there are additional perks with the purchase of a new Jaguar I-PACE. You will also get to enjoy exclusive benefits with the purchase of a new Tesla EV.

3. POSB Car Loan

| Type of information | Details |

| Website | https://www.posb.com.sg/personal/loans/car-loans/carloan |

| Highlights to Note | – Promotion: 1.99% p.a. fixed flat (EIR 3.77% p.a. based on a 7-year loan tenure) – Apply online through digibank or Singpass. |

| Contact Details | Tel: 1800 339 6666 |

The POSB Car Loan will be perfect for those who are looking for a simple and affordable car loan. It is also highly flexible as well as it gives you the choice to repay your loan anytime between 1 year to 7 years. The loan amount will be pegged to the Open Market Value (OMV). You can apply easily online either through digibank or Singpass.

POSB is currently having a promotion now where you can get to save more and worry less for your car – Apply for your car loan online at 1.99% p.a. fixed flat (EIR 3.77% p.a. based on a 7-year loan tenure). This loan is only available for vehicles that are not more than 10 years old from the original date of registration.

4. Speed Credit Used Car Loan

| Type of information | Details |

| Website | https://www.speedcredit.com.sg/used-car-loan/ |

| Highlights to Note | – From 1.68% Interest Rate – As fast as 1-2 Days Loan Approval – Since 2000, 100% Approval Rate – Up to 70% financing |

| Contact Details | Email: [email protected] Tel: +65 9851 8281 |

Speed Credit used car loan offers interest rates from 1.68% per annum and provides up to 70% financing. They also provide flexible loan repayments of up to 7 years. If you apply with Speed Credit, you can get loan approval as fast as 1-2 days. They have a 100% loan approval rate since 2000.

Since 2000, Speed Credit has helped thousands of Singaporeans, Singapore PRs, and Foreign Workers in financing their used cars. They have a 100% loan approval rate. You can trust them for the best rates and loan terms for you.

5. UOB Car Loan

| Type of information | Details |

| Website | https://www.uob.com.sg/personal/borrow/carloans/index.html |

| Highlights to Note | – Online platform for paperless application – Instant approval upon successful submission – Leverage personal data on MyInfo |

| Contact Details | Tel: 1800-388-2121 |

If you are looking for a fast and easy way to get a car loan, you can consider applying for the UOB Car Loan. It is fast, secure and hassle-free, most suited for buyers who only need a small loan amount. The minimum loan amount will start from S$10,000.

If you’re a Singapore Citizen or PR, you can leverage your personal data on MyInfo so you don’t need to fill in your details nor submit income documents. It will take approximately 10 minutes with the MyInfo application.

6. Maybank Car Loan

| Type of information | Details |

| Website | https://www.maybank2u.com.sg/en/personal/loans/car-loan/car-loan.page |

| Highlights to Note | – Attractive interest rates. – Flat rates for fixed monthly instalments – Loan up to 70% of the purchase price or valuation (whichever is lower). – Loan period of up to 7 years – Convenience of GIRO Payments. |

| Contact Details | Tel: +65 6550 7888 |

With Maybank car loan, car buyers can loan up to 70% of the purchase price or valuation of the car, whichever is lower. You will also get to enjoy attractive interest rates and a loan tenure of up to 7 years. To learn more, head down to the Maybank website to use their car loan calculator to understand how you can best finance your car.

To be eligible, you will need to be 21 years old and above, a Singapore Citizen, Singapore Permanent Resident, or a Foreigners with Employment Pass (with a local guarantor). You will also need a minimum monthly income of S$1,500.

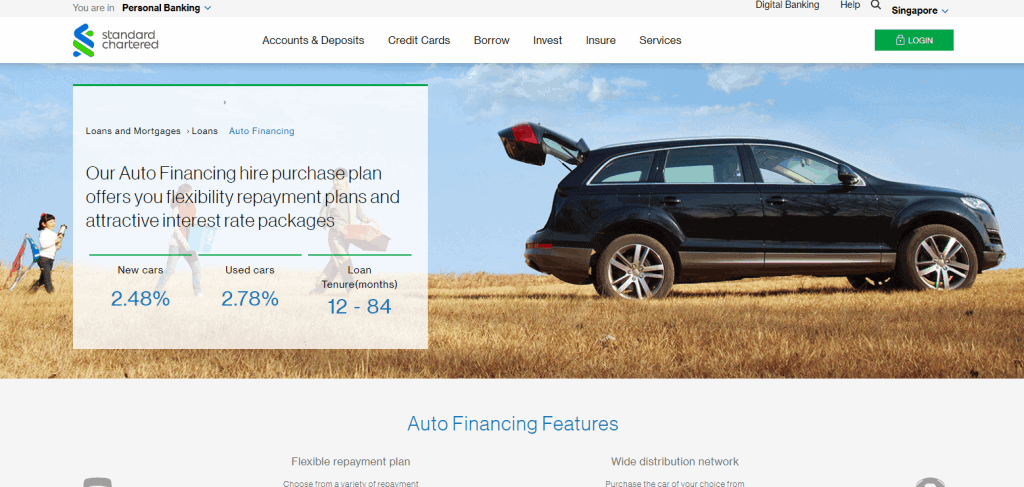

7. Standard Chartered Auto Financing

| Type of information | Details |

| Website | https://www.sc.com/sg/pricing-guide/#table-content-607262-22 |

| Highlights to Note | – Flexible repayment plan – Hassle-free application process – Attractive interest rates |

| Contact Details | https://www.sc.com/sg/help/forms/#sc-lb-module-fee-and-rate-1 |

Standard Chartered Auto Financing is a highly flexible car loan and would be great for buyers who want options where they can get their new or used car from. They offer flexible repayment plans, where you can get to choose from a variety of repayment plans, ranging from 12 to 84 months to lower your instalment payments.

In addition, you will get to enjoy attractive interest rate packages of 2.48% per annum for new cars and 0.78% per annum for used cars. There are multiple payment channels available in Singapore so it will be extremely convenient for you to do your car loan repayments.

8. Hong Leong Finance Car Loan

| Type of information | Details |

| Website | https://www.hlf.com.sg/personal/loans/new-car-loans.html |

| Highlights to Note | – Fast loan approval process – Commercial Vehicle Financing is also available – 2.48% p.a interest flat in advance |

| Contact Details | Tel: +65 6579 6777 |

With Hong Leong Finance Car loan, car buyers can enjoy fixed interest rate protection from rate hike, of a 2.48% per annum interest flat in advance. You can also enjoy flexibility in your repayment periods of up to 7 years of the loan tenure. Ease your mind with affordable instalments as Hong Leong Finance will provide up to 70% of the financing.

If you wish to view the latest interest rates or the calculator, you can head down to the website to find out more.

9. Swee Seng Used Car Loan

| Type of information | Details |

| Website | https://www.sweesengcredit.com/used-car-loan.html |

| Highlights to Note | – 1.68% per annum interest rate – Free Handling of LTA & Bank Transactions – Fast, Transparent & Hassle-Free Service |

| Contact Details | Email: [email protected] Tel: +65 6466 3808 |

Swee Seng Used Car Loan has a competitive interest rate of 1.68% per annum. They finance up to 60-70% of the loan and has a loan repayment period of up to 7 years. If you apply for a loan with them, they will make sure that you enjoy a hassle-free and convenient process as they will settle all the paperwork with you and full settlement with your seller on your behalf.

They also provide free handling of LTA and bank transactions, full settlement and car ownership transfer assistance

free financing advice and paperwork assistance. There are no middlemen involved and no mark-ups on interest rates. Fast, Swee Seng Used Car Loan is transparent with no hidden or additional charges.

10. Motorist COE Renewal Loan

| Type of information | Details |

| Website | https://www.motorist.sg/coe-renewal |

| Highlights to Note | – Lowest Loan Interest Rate Guarantee – Full 100% PQP Financing – Complimentary Pre-COE Inspection |

| Contact Details | Email: [email protected] Tel: +65 6589 8800 |

Need money for your COE renewal? Motorist is the right place to go. They make a strong promise that they have the lowest COE loan interest rate in Singapore. If you managed to find a lower loan interest rate elsewhere, they promised to give you $50!

Not only so, to ensure your car is suitable for COE renewal, Motorist will also arrange for a complimentary Pre-COE inspection at their partnered workshops. They also work with several approved banks and financial institutions, like UOB and Hong Leong Finance, to ensure that you get a full 100% COE loan.

Conclusion

Do you have any reviews and comments to share regarding our choices for the best car loans in Singapore for all car types?

While SBO is committed to supporting our local businesses, we welcome any feedback and anonymous sharing regarding your experience with the listed outdoor furniture in Singapore.

We hope that this guide will be useful in helping you to make an informed decision when it comes to finding the best car loans in Singapore.

Explore More Content

Table of Content