10 Best Cashback Credit Card in Singapore for Great Rewards [2025]

Cashbacks are a great way for you save money while spending. Here's the 10 best cashback credit card in Singapore that you can apply for to earn some rewards for yourself!

If you use your credit card often, cash backs would be a great way for you to save money. All you need to do is to charge all your spending to a cashback card, and you automatically receive a cashback rebate whenever you use your credit card to purchase items. Easy, isn’t it?

You can earn cashback via various categories such as dining, online shopping, groceries and transport. This cashback rebate acts like a form of credit that is given back to you in your next monthly credit card statement.

With a good cash back credit card, you will be able to save more and spend. Here’s the 10 best cashback credit card in Singapore you can check out to earn some amazing cash backs every month!

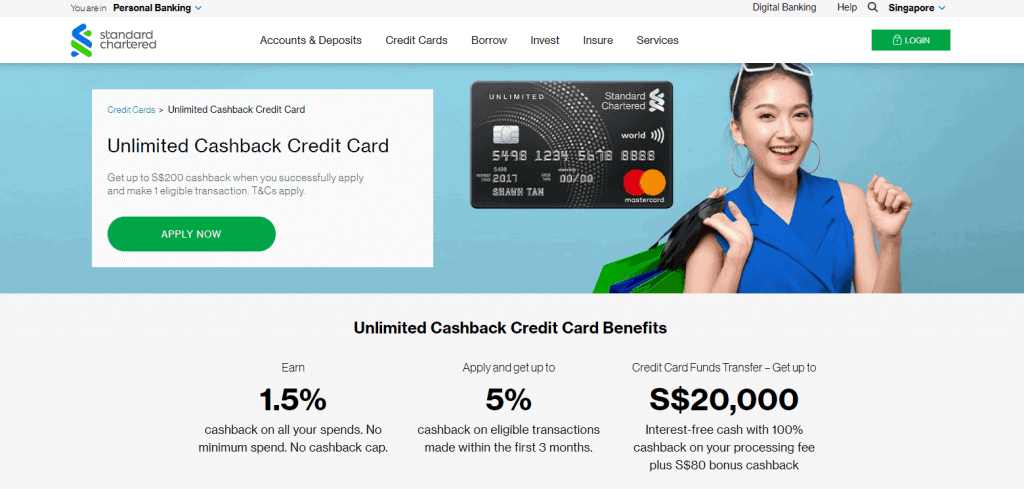

1. Standard Chartered Unlimited Cashback Credit Card

| Type of information | Details |

| Website | https://www.sc.com/sg/credit-cards/unlimited-cashback-credit-card/?subchancode=IB04 |

| Highlights to Note | – Earn 1.5% cashback on all your spends – Apply and get up to 5% cashback on eligible transactions made within the first 3 months |

| Contact Details | https://www.sc.com/sg/help/contact-us/ |

With the Standard Chartered Unlimited Cashback Credit Card, you can earn 1.5% cashback on all your spending. This includes all your online shopping, grocery shopping, anything that you spend using the Standard Chartered Unlimited Cashback Credit Card. There is no minimum spend needed and no cashback cap. Amazing, isn’t it?

Standard Chartered is having a promotion now – Get up to S$200 cashback when you successfully apply and make 1 eligible transaction. T&Cs apply.

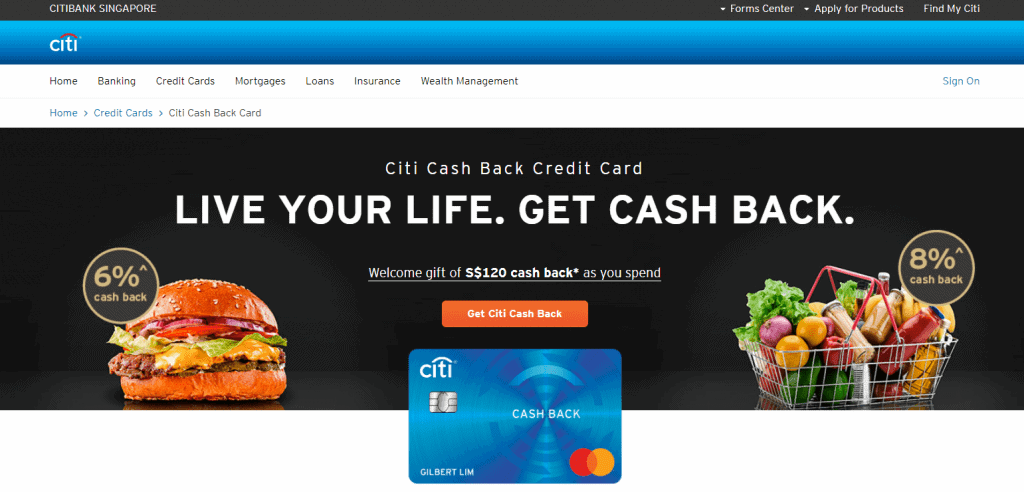

2. Citi Cash Back Card

| Type of information | Details |

| Website | https://www.citibank.com.sg/credit-cards/cashback/citi-cash-back-card/ |

| Highlights to Note | – High cashback of 8% on groceries and petrol – High cashback of 6% on dining – Up to 20.88% fuel savings+ at Esso and Shell and 8% cashback at other petrol stations worldwide |

| Contact Details | Tel: +65 6225 5225 |

Citi Cash Back Credit Card comes with a high cashback of 8% on groceries and petrol, and 6% on dining, making it perfect for dining and grocery shopping, All you need to do is to make sure you spend a monthly minimum spend of S$800 per month to earn cashback.

The cashback amounts are capped at S$80 per month for dining, groceries, and petrol.

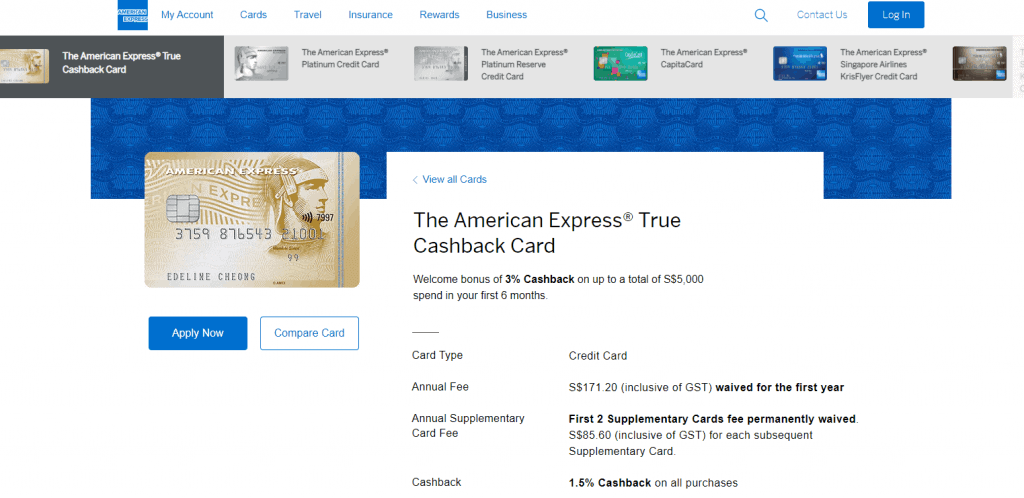

3. American Express True Cashback Card

| Type of information | Details |

| Website | https://www.americanexpress.com/sg/credit-cards/true-cashback-card/ |

| Highlights to Note | – 1.5% Cashback on all purchases – No minimum spend, no cap on Cashback and no categories to track |

| Contact Details | Tel: 1800 299 1997 |

American Express True Cashback Card allows you to earn 1.5% cashback on all purchases. Their annual fee of S$171.20 (inclusive of GST) was waived for the first year. It is the cashback credit card to go for now if you wish to enjoy all their promotions benefits.

First off, as a welcome bonus, you will earn 3% Cash Back on up to a total of S$5,000 spend in your first 6 months. Subsequently, you can continue to earn 1.5% Cash Back on all eligible purchases. There is no minimum spending and no earn cap.

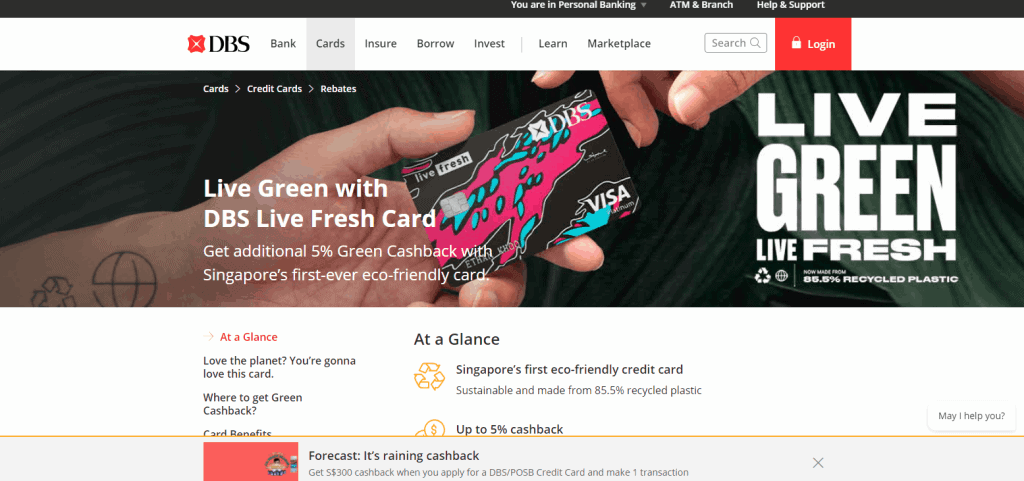

4. DBS Live Fresh

| Type of information | Details |

| Website | https://www.dbs.com.sg/personal/cards/credit-cards/live-fresh-dbs-visa-paywave-platinum-card |

| Highlights to Note | – Singapore’s first eco-friendly credit card – Up to 5% cashback On Online & Visa Contactless Spend – Additional 5% Green Cashback On selected Eco-Eateries, Retailers and Transport Services |

| Contact Details | Tel: 1800 111 1111 |

If you are big on going green and being eco-friendly, the DBS Live Fresh credit card is the right card for you. It is made with 85.5% recycled plastic, making it the first-ever eco-friendly credit card in Singapore. You can get to enjoy up to 5% cashback On Online & Visa Contactless Spend and an additional 5% Green Cash Back On selected Eco-Eateries, Retailers and Transport Services.

Cash Back will be capped at S$20 on online spend, S$20 on eligible Visa contactless spend, S$15 on sustainable spend, S$20 on all other spend each month. You will need to have a minimum spend of S$600 per month to enjoy these cash backs.

5. OCBC 365

| Type of information | Details |

| Website | https://www.ocbc.com/personal-banking/cards/365-cashback-credit-card |

| Highlights to Note | – 6% cashback on dining and online food delivery – 3% cashback on groceries, land transport, online travel, and utilities – Cover worldwide transactions |

| Contact Details | Tel: +65 6363 3333 (24-hour) |

With OCBC 365 Credit Card, get ready to enjoy cashback 7 days a week, 365 days a year, everywhere. With a 6% cashback on dining & online food delivery, 3% cashback on groceries, land transport, utilities and online travel, and up to 22.1% fuel savings at Caltex, OCBC 365 makes sure to get you the most out of your everyday spending.

6. HSBC Visa Platinum Credit Card

![10 Best Cashback Credit Card in Singapore for Great Rewards [[year]] 1](https://sbo.sg/wp-content/uploads/2021/07/hsbc-1024x490.png)

| Type of information | Details |

| Website | https://www.hsbc.com.sg/credit-cards/products/visa-platinum/ |

| Highlights to Note | – 5% cash rebate on your family spend – Deals for your family – Get 1 Reward point per dollar spent on anything your family fancies. |

| Contact Details | https://www.hsbc.com.sg/help/ |

HSBC Visa Platinum Credit Card is your go-to cashback credit for all families. You can enjoy a 5% cash rebate on your family spend if you are spending it on dining, groceries and fuel. There are also exclusive discounts and offers that are family-centric, just for yourself and the kids. Your annual fee will be waived for the first 2 years.

If you apply online with Myinfoapply online with Myinfo, you will be able to receive SGD30 cashback. Moreover, you will earn 1 Reward point per dollar spent on anything your family fancies. Now you understand why this is the perfect cashback credit card in Singapore for families.

7. UOB Evol Card

| Type of information | Details |

| Website | https://www.uob.com.sg/personal/cards/credit-cards/rebates-cards/evol/index.page?s_cid=pfs:sg:paid:sea:go:na:tx:na:001454:170521-evergreen:na:cvp_cashback:pc-go&vid=purpleclick_google |

| Highlights to Note | – 8% cashback on online spend – 8% cashback on mobile contactless payments – 0.3% cashback on other spendings |

| Contact Details | Tel: 1800 222 2121 |

If you frequently pay payments via mobile contactless payment platforms like Apple Pay, Samsung Pay and Fitbit Pay, the UOB EVOL Card is the right card for you.

You can enjoy up to 8% cashback on online spending, 8% cashback on mobile contactless payments and 0.3% cashback on other spend with the UOB EVOL Card. All you need to do is to have a minimum spend of S$600 per month to enjoy these attractive cash backs. The cashback will be capped at S$60 per month.

8. CIMB World Mastercard

![10 Best Cashback Credit Card in Singapore for Great Rewards [[year]] 2](https://sbo.sg/wp-content/uploads/2021/07/CIMB-1-1024x482.png)

| Type of information | Details |

| Website | https://www.cimb.com.sg/en/personal/banking-with-us/cards/credit-cards/cimb-world-mastercard.html |

| Highlights to Note | – Enjoy unlimited 2% cashback on Wine & Dine, Entertainment & Recreation, Automobile and Duty-Free Store purchases – Unlimited 1.5% cashback on all other spendings |

| Contact Details | https://www.cimbbank.com.sg/en/personal/forms/cards/cimb-world-mastercard.html#! |

The CIMB World Mastercard allows you to earn 2% cashback on dining, entertainment, automobile and duty-free transactions. You will earn an unlimited 1.5% cashback for all other spendings.

There is no minimum spend or cap. Not only so, but you also do not need to pay any annual fee, which can be a huge barrier of entry for some.

9. OCBC Frank Card

| Type of information | Details |

| Website | https://www.frankbyocbc.com/products/cards/credit-card |

| Highlights to Note | – 6% cashback for online spending on all the things you enjoy – Up to S$75 cashback for your online and in-app spending, contactless mobile payments and other spendings |

| Contact Details | Tel: +65 6363 3333 (24-hour) |

With the OCBC Frank card, cardholders will get earn 6% cashback for online spending on all purchases. You can also earn 0.3% cashback on all other purchases. This translates to up to S$75 cashback in your pocket each month.

All you need to do is to achieve a S$600 monthly minimum spend on anything online and everywhere that accepts contactless mobile payments in-store.

10. CIMB Visa Signature Card

| Type of information | Details |

| Website | https://www.cimb.com.sg/en/personal/banking-with-us/cards/credit-cards/cimb-visa-signature.html |

| Highlights to Note | – 10% cashback on Online Shopping, Groceries and more – Unlimited 0.2% cashback |

| Contact Details | https://www.cimbbank.com.sg/en/personal/forms/cards/cimb-visa-signature.html#! |

With CIMB Visa Signature Card, you can get to enjoy 10% cashback when you do online shopping, buy groceries, spend in areas such as beauty and wellness, pet shops and veterinary services and cruises.

There will also be unlimited 0.2% cashback on other retail purchases with no minimum spend or monthly cap. They have over 1,000 CIMB Deals & Discounts across dining, retail and lifestyle outlets in Singapore, Malaysia and Indonesia for you to enjoy!

Conclusion

Do you have any reviews and comments to share regarding our choices for the best cashback credit card in Singapore?

While SBO is committed to supporting our local businesses, we welcome any feedback and anonymous sharing regarding your experience with the listed outdoor furniture in Singapore.

We hope that this guide will be useful in helping you to make an informed decision when it comes to finding the best cashback credit card in Singapore.

Explore More Content

Table of Content