A Deep Look into 6 Business Bank Accounts in Singapore (2026): How to choose the best one?

Compare all the banking options and find the best corporate bank account for you.

When starting a business in Singapore, one of the key decisions is choosing the right corporate bank account.

When I started my business 10 years ago, the options were limited to the usual big banks like DBS, OCBC, UOB, and Maybank. Nowadays, with the rise of neo-banks, there are many more choices to consider.

Here are some factors to think about when deciding on a bank account:

Reputation and Reliability

This is the most important factor. You wouldn’t want to store a large amount of funds with an unreliable provider that might close down unexpectedly. If considering neo-banks, check their track records for reliability.

Cheques

In the past, the ability to issue cheques was crucial for doing business in Singapore. We had to consider the cost of cheque books when choosing a bank. However, with the growing preference for digital transfers, think about whether you’ll need to use cheques when dealing with vendors, clients, and staff.

PayNow

With the rise of PayNow, it’s beneficial if your bank can create a PayNow QR code for you, especially if you deal with B2C markets.

Local & Overseas Transactions Fees

Check the fees for telegraphic transfers (TT) and the speed of transactions, particularly if you frequently deal with overseas transactions. For local transfers, find out if there are any fees for FAST and GIRO transfers.

Shared Access

Sometimes you wish your team member could help you pay for something, but you don’t want them to know the total balance of the company bank account.

Evaluate how easily you can share controlled banking access with partners or team members. This feature is very useful for tasks like making monthly payments to vendors or freelancers.

It allows team members to handle payments without requiring your direct involvement, saving you time and also keeping your account balance confidential.

Integration with Accounting Software

This is a must-have if you handle your own bookkeeping. Integration with major accounting softwares makes bank reconciliation much easier. Without it, you’d need to manually enter each transaction or deal with importing and exporting data files in compatible formats.

Minimum Account Balance

Consider the minimum account balance required to avoid charges. This can be a key factor in your decision.

Relationship with the Bank

Think strategically about your future business needs. As your business grows, you might need to take out a business loan. The easiest bank to approach for a loan is often the one where your main company account is. So, if you anticipate needing a loan, consider opening your account with that bank.

Corporate Cards

Companies often don’t have credit cards but do need debit cards to facilitate payments for online purchases or business expenses like meals. It’s important to verify if the bank can issue corporate cards, as these are essential for managing day-to-day transactions and streamlining expense management.

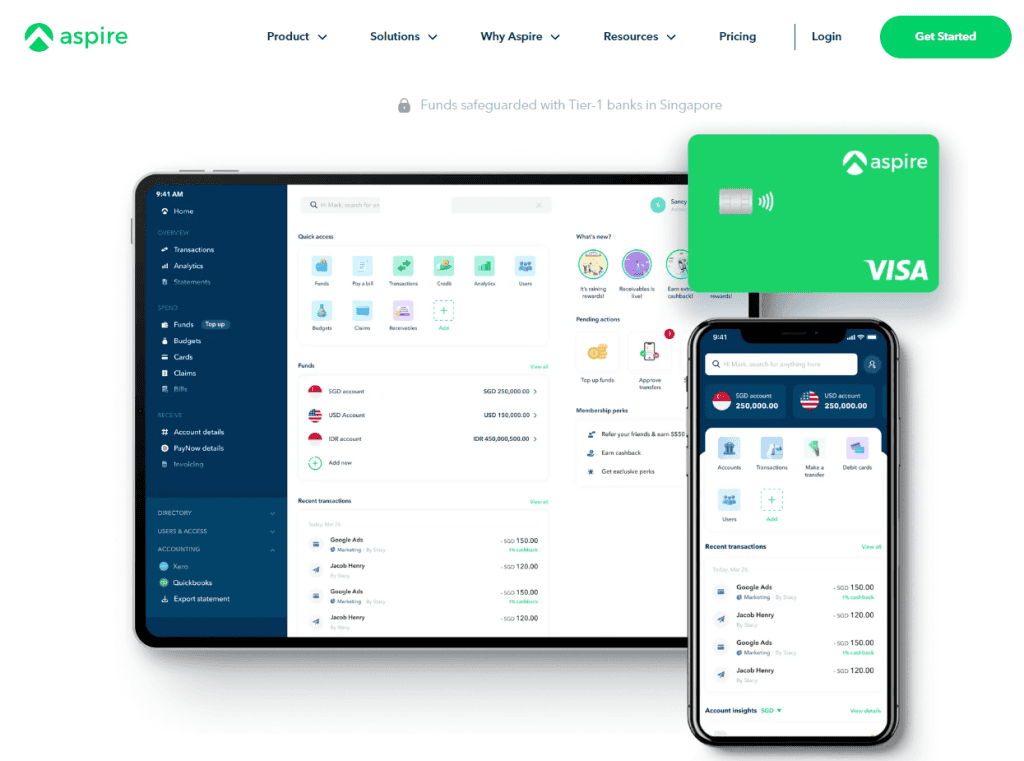

1. Aspire

| Factor | Details |

|---|---|

| Reputation and Reliability | Aspire is well-regarded in the fintech space, particularly among SMEs. It has built a solid reputation for reliability and innovation in digital banking. |

| Account Fees | Free |

| Cheques | Aspire does not offer cheque services, reflecting the shift towards digital transactions. |

| PayNow | Aspire allows you to receive payment through PayNow with a Virtual Payment Address (not UEN). |

| Local & Overseas Transaction Fees | Aspire offers free local transfer and competitive fees (3x cheaper) for overseas transactions. It supports international transfers and provides transparency on fees and exchange rates. |

| Sharing Access | Aspire allows easy sharing of controlled access to team members. This feature is designed to facilitate efficient management of finances within a business team. |

| Integration with Accounting Software | Aspire integrates with popular accounting software like Xero and QuickBooks, making bookkeeping and financial management seamless for businesses. |

| Minimum Account Balance | Aspire does not require a minimum account balance, making it an attractive option for startups and small businesses with limited initial funds. |

| Bank Loans | When you register for an Aspire Account, you get approved for a credit limit of up to $150,000 for a revolving line of credit. |

| Ability to Pay through Corporate Cards | Aspire provides virtual and physical corporate Visa cards, enabling easy and secure business payments and expense management. |

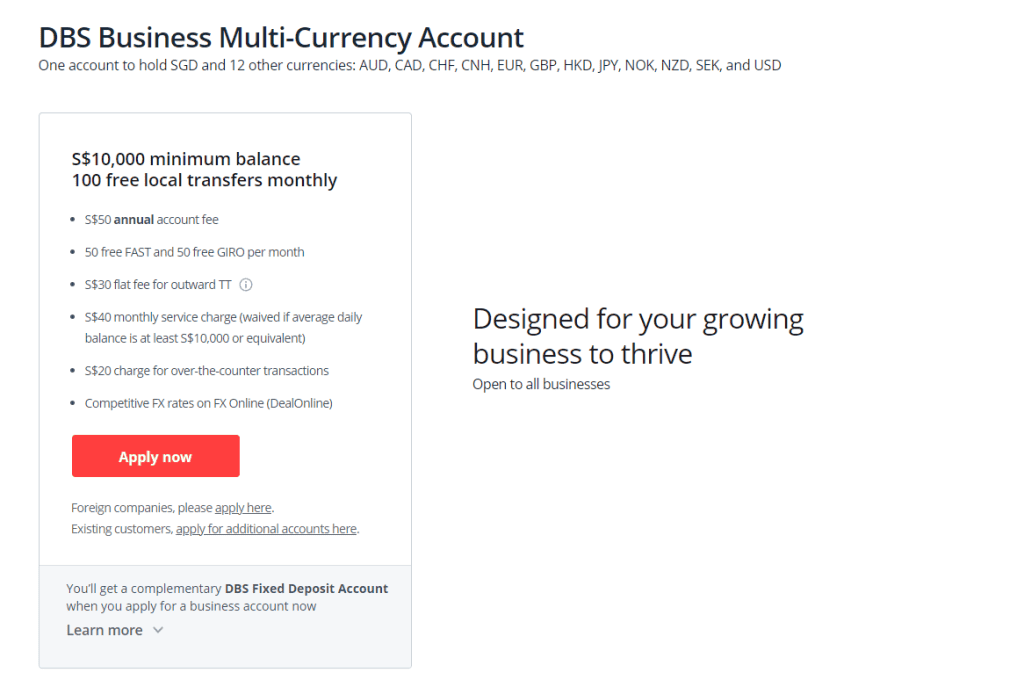

2. DBS Business Multi-currency Account

DBS, established in 1968, is one of the largest and most reputable banks in Singapore. It is renowned for its comprehensive range of financial services, robust digital banking capabilities, and strong customer support. DBS has consistently been recognized for its innovation and reliability, making it a popular choice among businesses in Singapore.

| Factor | Details |

|---|---|

| Reputation and Reliability | DBS is one of Singapore’s most trusted and reliable banks, known for its stability and extensive track record in the financial industry. |

| Account Fees | S$50 annual fee |

| Cheques | DBS offers cheque services, including issuing cheque books, which can be useful for businesses that still require cheque transactions. |

| PayNow | DBS supports PayNow, allowing businesses to generate PayNow QR codes for seamless B2C transactions. |

| Local & Overseas Transaction Fees | DBS provides 50 free local transfers (GIRO/FAST) and competitive overseas TT fees (S$30 flat). |

| Sharing Access | DBS offers robust solutions for sharing controlled access with partners or team members, facilitating efficient financial management and approval workflows. |

| Integration with Accounting Software | DBS integrates with popular accounting software like Xero, MYOB and QuickBooks, making it easier for businesses to manage their finances and perform bank reconciliation. |

| Minimum Account Balance | DBS requires a minimum account balance (S$10,000) to avoid charges, which can vary depending on the type of SME account. |

| Bank loans | DBS has a strong relationship management team and offers various business loan options, making it easier for businesses to secure funding as they grow. |

| Ability to Pay through Corporate Cards | DBS provides both debit and credit corporate cards, offering flexibility and convenience for managing business expenses and online transactions. |

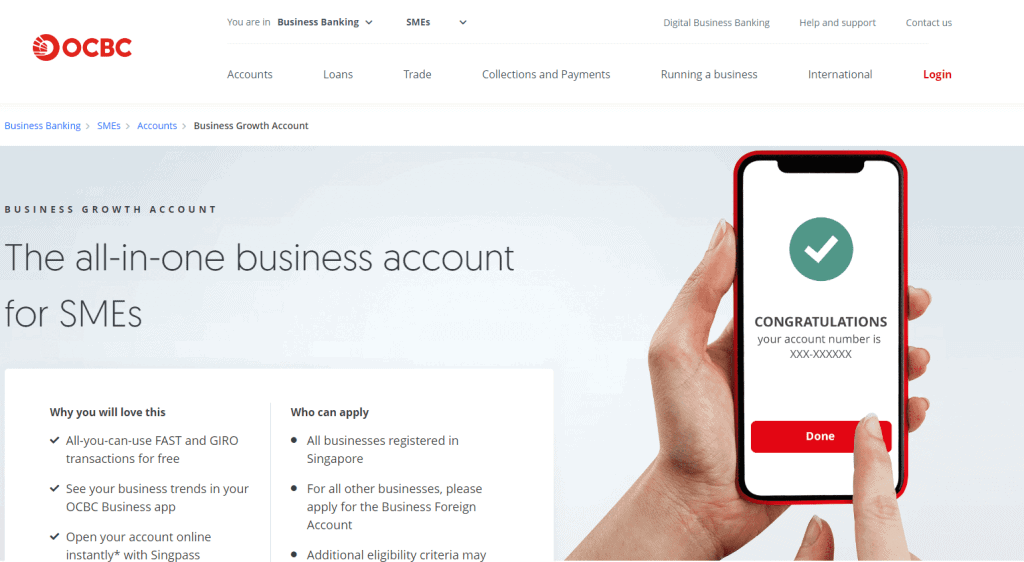

3. OCBC Business Growth Account

OCBC (Oversea-Chinese Banking Corporation), established in 1932, is one of Singapore’s leading banks, well-known for its strong presence in the SME sector and comprehensive range of financial products. OCBC is renowned for its stability, customer-centric services, and innovative digital banking solutions, making it a popular choice for small and medium-sized enterprises (SMEs) in Singapore.

| Factor | Details |

|---|---|

| Reputation and Reliability | OCBC is one of Singapore’s most trusted banks, with a long-standing reputation for reliability and strong financial health. |

| Bank Fees | Monthly S$10 |

| Cheques | OCBC provides cheque issuance services, which can be useful for businesses that still require cheque transactions. |

| PayNow | OCBC supports PayNow, allowing businesses to create PayNow QR codes for seamless B2C transactions. |

| Local & Overseas Transaction Fees | OCBC offers competitive fees for both local (unlimited free) and overseas transactions. It supports FAST, GIRO, and telegraphic transfers (TT), with transparent fee structures. |

| Sharing Access | OCBC allows for controlled sharing of banking access with partners or team members. This feature is useful for making payments without disclosing the account balance. |

| Integration with Accounting Software | OCBC integrates with popular accounting software like Xero and QuickBooks, making it easier for businesses to manage their finances and perform bank reconciliation. |

| Minimum Account Balance | The OCBC Business Growth Account requires a minimum account balance (S$1,000) to avoid charges, though it is relatively low, making it accessible for SMEs. |

| Bank Loans | OCBC offers strong relationship management and various business loan options, making it easier for businesses to secure funding as they grow. |

| Corporate Cards | OCBC provides both debit and credit corporate cards, offering flexibility and convenience for managing business expenses and online transactions. |

4. UOB Corporate Banking

United Overseas Bank (UOB), established in 1935, is a major bank in Singapore known for its extensive range of financial products and services tailored to small and medium-sized enterprises (SMEs). UOB is highly regarded for its stability, innovative banking solutions, and strong focus on customer relationships, making it a trusted partner for businesses in Singapore.

| Factor | Details |

|---|---|

| Reputation and Reliability | UOB is one of Singapore’s most reputable banks, known for its stability and long-standing presence in the financial sector. |

| Bank Fees | S$35 |

| Cheques | UOB offers cheque services, which are useful for businesses that still require cheque transactions. |

| PayNow | UOB supports PayNow, enabling businesses to create PayNow QR codes for easy and efficient B2C transactions. |

| Local & Overseas Transaction Fees | UOB provides competitive fees for both local and overseas transactions, including FAST, GIRO, and telegraphic transfers (TT), with transparent fee structures. |

| Sharing Access | UOB allows controlled sharing of banking access with partners or team members. This feature is useful for delegating payment tasks while keeping account balances confidential. |

| Integration with Accounting Software | UOB integrates with popular accounting software like Xero and QuickBooks, facilitating seamless financial management and bank reconciliation. |

| Minimum Account Balance | UOB requires a minimum account balance (S$1,000) to avoid charges, which can vary depending on the type of SME account. |

| Bank Loans | UOB offers strong relationship management and a variety of business loan options, making it easier for businesses to secure funding as they grow. |

| Corporate Cards | UOB provides both debit and credit corporate cards, offering flexibility and convenience for managing business expenses and online transactions. |

5. Wise

![A Deep Look into 6 Business Bank Accounts in Singapore ([year]): How to choose the best one? 1](https://sbo.sg/wp-content/uploads/2024/06/image-4-1024x418.png)

Wise, formerly known as TransferWise, was established in 2011 and has gained international recognition for its innovative approach to money transfers. Known for its transparency, low fees, and excellent exchange rates, Wise has become a popular choice for businesses that frequently deal with international transactions. Wise offers a multi-currency account that allows businesses to hold and manage money in multiple currencies, making it ideal for SMEs engaged in global trade.

| Factor | Details |

|---|---|

| Reputation and Reliability | Wise is highly reputable for its transparency, reliability, and innovative financial solutions, especially in the realm of international money transfers. |

| Bank Fees | Free |

| Cheques | Wise does not offer cheque services, reflecting its focus on digital transactions and modern banking solutions. |

| PayNow | Wise does not currently support PayNow, as it primarily focuses on international transactions and digital payment solutions. |

| Local & Overseas Transaction Fees | Wise is known for its low and transparent fees for international transfers. It offers competitive exchange rates and detailed fee breakdowns, ensuring cost-efficiency for businesses. For local transfers, Wise supports FAST and other digital transfer methods with minimal fees. |

| Sharing Access | Wise allows controlled sharing of account access with team members. This feature enables businesses to delegate payment tasks without compromising security or revealing the entire account balance. |

| Integration with Accounting Software | Wise integrates with popular accounting software like Xero, making it easier for businesses to manage their finances and perform bank reconciliation efficiently. |

| Minimum Account Balance | Wise does not require a minimum account balance, making it an attractive option for startups and small businesses with limited initial funds. |

| Bank Loans | As a digital-first platform, Wise focuses on providing excellent online support and resources for businesses. It does not offer traditional business loans but provides various financial tools to support global operations. |

| Corporate Cards | Wise provides multi-currency debit cards that allow businesses to pay for expenses in different currencies at competitive exchange rates, facilitating easy and cost-effective global transactions. |

6. Maybank Corporate Banking

![A Deep Look into 6 Business Bank Accounts in Singapore ([year]): How to choose the best one? 2](https://sbo.sg/wp-content/uploads/2024/06/image-5-1024x278.png)

Maybank, established in 1960, is one of the largest banks in Southeast Asia, with a significant presence in Singapore. It is well-known for its strong commitment to providing comprehensive financial solutions to small and medium-sized enterprises (SMEs). Maybank is renowned for its stability, extensive branch network, and customer-centric services, making it a trusted partner for businesses in Singapore.

| Factor | Details |

|---|---|

| Reputation and Reliability | Maybank is a highly reputable and stable bank with a strong presence in Southeast Asia, trusted by numerous SMEs for its reliability and extensive banking services. |

| Bank Fees | No monthly fees for FlexiBiz |

| Cheques | Maybank offers cheque services, which can be useful for businesses that still require cheque transactions. |

| PayNow | Maybank supports PayNow, enabling businesses to create PayNow QR codes for seamless and efficient B2C transactions. |

| Local & Overseas Transaction Fees | Maybank provides competitive fees for both local and overseas transactions. It supports FAST, GIRO, and telegraphic transfers (TT), with clear fee structures. |

| Sharing Access | Maybank offers controlled access sharing, allowing businesses to delegate payment tasks to team members without disclosing the total account balance. |

| Integration with Accounting Software | Maybank integrates with popular accounting software like Xero and QuickBooks, making it easier for businesses to manage their finances and perform bank reconciliation. |

| Minimum Account Balance | Maybank requires a minimum account balance (S$1,000) to avoid charges, which can vary depending on the type of SME account. |

| Relationship with the Bank | Maybank has a strong relationship management team and offers various business loan options, making it easier for businesses to secure funding as they grow. |

| Corporate Cards | Maybank provides both debit and credit corporate cards, offering flexibility and convenience for managing business expenses and online transactions. |

Conclusion

Personally, I would choose to use two banks. I would still rely on one of the major banks to store most of the company’s funds, ensuring stability and reliability. Additionally, I would opt for a neo-bank solution for day-to-day operations.

Neo-banks are rapidly innovating and implementing better tools that significantly enhance business operations and management. This combination allows me to leverage the strengths of both traditional and digital banking to optimize financial management for my business.

Frequently Asked Questions

What are neo-banks?

Neo-banks are digital-only banks that operate without traditional physical branch networks. They offer innovative banking solutions and services primarily through mobile apps and online platforms, often providing lower fees and enhanced digital experiences compared to traditional banks.

Note: This post contains affiliate links, which revenue will contribute to the growth and sustainability of this site.

Explore More Content

Table of Content