10 Best Travel Insurance in Singapore for that Next Flight Out [2025]

With the gradual opening up of travel, we see travel starved Singaporeans rushing to get that flight ticket out of Singapore.

With the gradual opening up of travel, we see travel starved Singaporeans rushing to get that flight ticket out of Singapore.

Getting the right travel insurance during this period becomes all the more important, so read on for our top travel insurance in Singapore picks to cover you on your next trip!

1. AXA Wanderlust Travel Insurance

| Type of Information | Details |

| Website | https://www.axa.com.sg/travel-insurance |

| Coverage and Benefits | – Medical expenses – Overseas hospitalisation allowance – Travel inconveniences *Singsaver promo: Get a $10 PayNow reward when you apply from 1 – 31 Dec 2021 *Insurer’s promo: Use promo code WSDC10 to receive a 50% discount and a bonus 20% discount for single plans. Use promo code WADC10 when applying to receive a 20% discount and a bonus 20% discount from 1 – 31 Dec 2021 |

| COVID-19 Cover Add-On | COVID-19 extension includes: – Overseas medical expenses – Overseas hospitalisation allowance – Emergency medical evacuation and/or repatriation – Pre-departure trip cancellation or postponement – Trip curtailment or rearrangement losses |

| Cost | S$67.30 for the most extensive Pro plan. Do check out the website for customisation based on age and destination. |

Choose from their range of affordable plans based on your travel needs. They offer 3 plans – Lite, Easy and Pro plan. If you would like more medical expenses coverage, you can opt for the Easy or Pro plans which offer S$250,000 and S$300,000 respectively for medical expenses coverage.

Furthermore, the Pro plan covers up to S$500,000 for personal accident coverage.

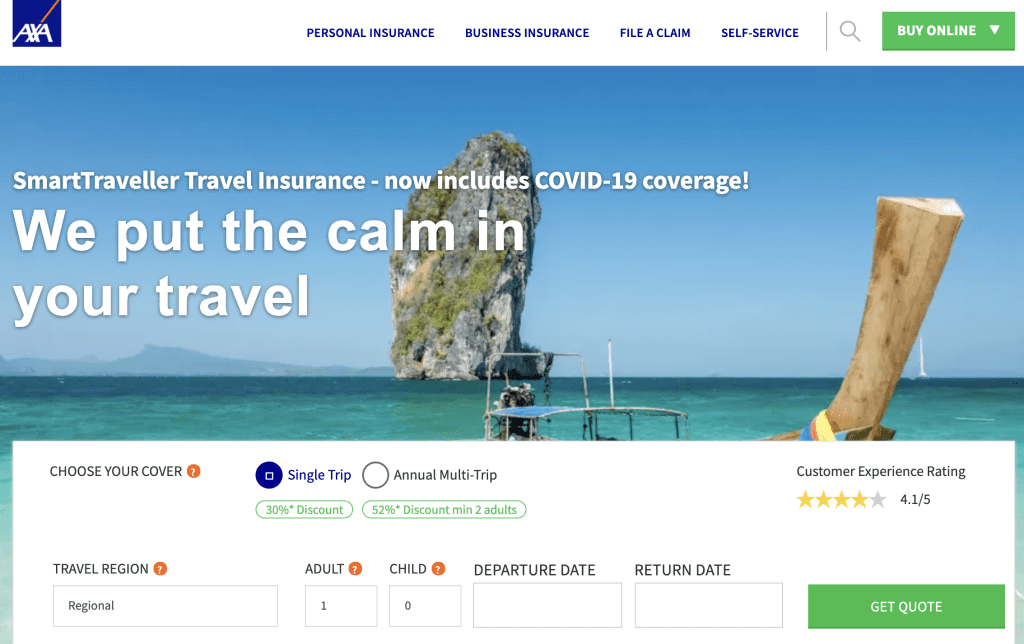

2. AXA SmartTraveller Travel Insurance

| Type of Information | Details |

| Website | https://www.axa.com.sg/travel-insurance/smarttraveller |

| Coverage and Benefits | – Medical expenses – Travel inconveniences – Emergency medical repatriation – Legal assistance – Terrorism cover *Singsaver promo: Get a $10 PayNow reward when you apply from 1 – 31 Dec 2021 *Insurer’s promo: Use promo code TSDC10 when applying to receive a 30% discount and a bonus 10% discount for single plans. Use promo code TADC10 when applying to receive a 20% discount and a bonus 8% discount for annual plans from 1 – 31 Dec 2021 |

| COVID-19 Cover Add-On | Benefits include medical expenses, overseas hospitalisation allowance, overseas quarantine allowance, emergency medical evacuation and repatriation, pre-departure trip cancellations and postponement, and trip curtailment or rearrangement losses. |

| Cost | S$63.38 for the essential plan. Do check out the website for customisation based on age and destination. |

Be a smart traveller and make sure to take all the necessary precautions with AXA’s SmartTraveller insurance. One can consider their essential plan which provides the most basic coverage or opt for the comprehensive plan which provides more extensive coverage.

The comprehensive plan is quite value for money, covering medical expenses up to S$600,000, twice that of what the essential plan covers with just a small top-up. Indeed one of our top travel insurance in Singapore picks!

3. MSIG TravelEasy

| Type of Information | Details |

| Website | https://www.msig.com.sg/personal-insurance/traveleasy |

| Coverage and Benefits | – Personal accident cover – Medical and related benefits cover – Travel inconvenience cover – Personal liability cover – Lifestyle cover – Safety cover *Singsaver promo: Get a $10 PayNow reward for both single and annual plans from 22 Nov – 31 Dec *Insurer’s promo: For single plans, enjoy 20% off your premiums upon successful application. For annual plans, receive a complimentary Polymerase Chain Reaction (PCR) test worth $138 when you apply from 22 Nov – 31 Dec |

| COVID-19 Cover Add-On | For Single Trip COVID-19 Cover is automatically included when you apply for single trip policy For Annual Plan To include COVID-19 Cover for your upcoming trip, additional premium may be charged depending on the area of travel |

| Cost | S$70.50 for standard plan. Do check out the website for customisation based on age and destination. |

TravelEasy provides comprehensive cover with over 50 benefits and also COVID-19 coverage which is automatically included for Single Trip plans.

Furthermore, they are running a promotion now where one can enjoy 20% off for Single Trip plans and also get a free Polymerase Chain Reaction (PCR) test (worth S$138) when you purchase the Annual Plan.

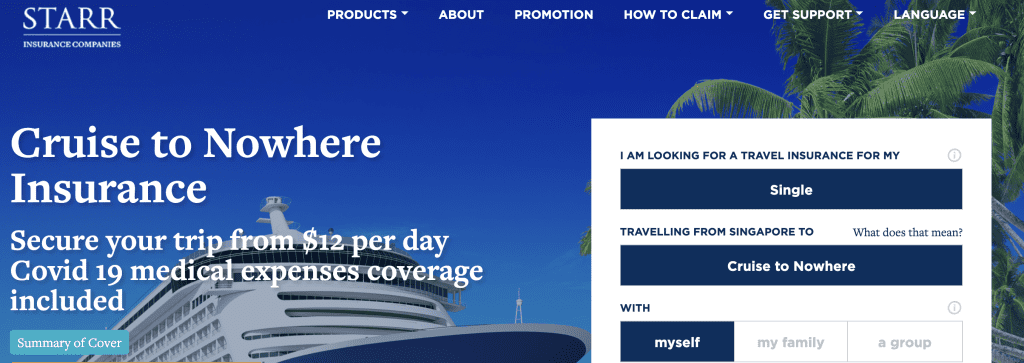

4. Starr Cruise-to-No-Where

| Type of Information | Details |

| Website | https://starrcompanies.com/ |

| Coverage and Benefits | – Overseas Covid 19 related medical expenses of up to $100,000 SGD – Medical expenses up to SG$1,000,000 including in and outpatient treatments – No sublimit or restriction on outpatient expenses and number of visits – Personal accident benefit of up to SG$500,000, covering 18 different events of disablement and accidental death *Singsaver promo: Get a $10 PayNow reward for both single and annual plans from 1 Dec – 31 Dec |

| COVID-19 Cover Add-On | Covid 19 medical expenses and Covid 19 related trip cancellation coverages of up to $1,000 SGD |

| Cost | S$21 for Essential plan. Do check out the website for customisation based on plans |

With the slowing down of air travel, cruises to nowhere have been all the hype. Insurers such as Starr Insurance have cruise insurance tailored for each individual.

Other than the above-stated benefits, they provide 24 hours Global Emergency Assistance Services for medical treatment and transportation.

We also like them for the seamless payment process which can be done through PayNow, indeed one of our top travel insurance in Singapore!

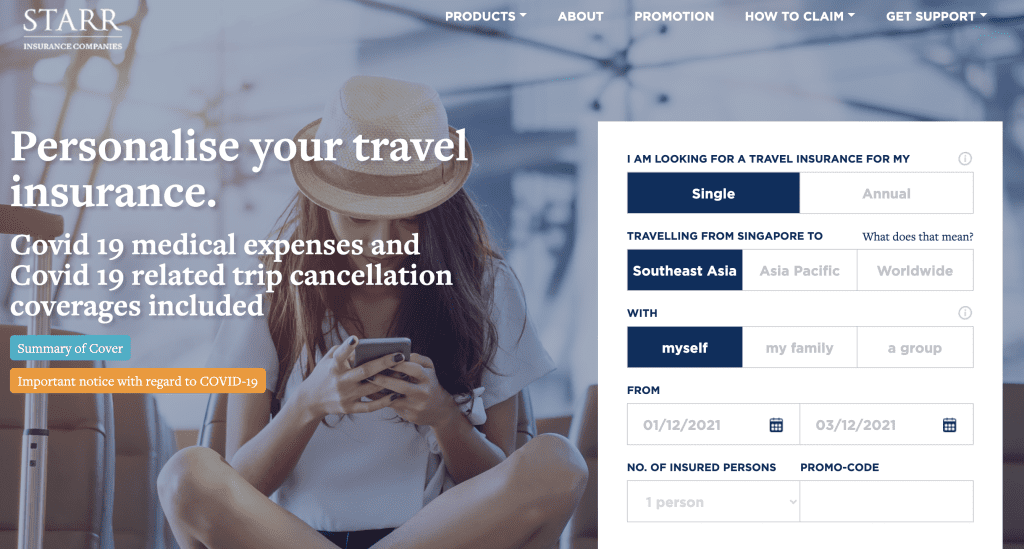

5. Starr TravelLead Insurance

| Type of Information | Details |

| Website | https://www.starrinsurance.com.sg/ |

| Coverage and Benefits | – Overseas Covid 19 related medical expenses of up to $100,000 SGD – Medical expenses up to SG$1,000,000 including in and outpatient treatments – No sublimit or restriction on outpatient expenses and number of visits – Personal accident benefit of up to SG$500,000, covering 18 different events of disablement and accidental death *Singsaver promo: Get a $10 PayNow reward for both single and annual plans from 1 Dec – 31 Dec *Insurer promo: Promo code SSTL25 to get 25% discount upon application. For Travel to All countries with VTL arrangement with Singapore, enjoy 35% discount when you apply using the promo code SSVTL35 |

| COVID-19 Cover Add-On | Covid 19 medical expenses and Covid 19 related trip cancellation coverages of up to $1,000 SGD |

| Cost | S$23 for Essential plan. Do check out the website for customisation based on age and destination. |

Like many other insurance plans, the Starr Insurance travel insurance plan allows for customisation between an annual trip plan and also single trip plans. All of their plans have medical coverage which covers:

- Accidental Death and Disablement

- Compassionate Death Cash due to Accident

- Medical Expenses

- Starr Global Emergency Assistance Services

Easily choose add-ons for your plans such as gold protection, cruise vacations, scuba diving and also snow sports! We like them for their flexible coverage which allows you to create a travel insurance plan with different types of coverage and add-ons.

6. FWD Travel Insurance

| Type of Information | Details |

| Website | https://www.fwd.com.sg/travel-insurance/ |

| Coverage and Benefits | – Overseas medical expenses – Theft to personal belongings – Travel delay – Baggage delay – Worldwide emergency assistance |

| COVID-19 Cover Add-On | Up to 30 days before your trip Up to S$1,000 in non-refundable costs for trip cancellation due to COVID-19 During your trip Up to S$100,000 in COVID-19 medical expenses incurred during/after your trip, additional coverage for trip disruption, and more Within 14 days after your trip S$200/day for up to 14 days for local hospitalisation due to COVID-19 |

| Cost | S$27 for the premium plan. Do check out the website for customisation based on age and destination. |

FWD offers 3 types of insurance plans – from the most basic premium plan to the mid-tier business plan and the first plan which offers the most coverage.

Some things we like about FWD’s travel insurance is the range of convenient payment modes that they offer, allowing clients to pay with PayNow and Grabpay etc. The prices offered are also pretty affordable with no hidden costs!

7. Allianz Travel

| Type of Information | Details |

| Website | https://www.allianz-assistance.com.sg/travel-insurance.html |

| Coverage and Benefits | – Medical cover – Protection against cancellations and interruptions – Rental car damage and theft excess coverage – Passport and money replacement – Cruise trip and sports equipment cover |

| COVID-19 Cover Add-On | COVID-19 coverage provided for policies purchased after 28 Jan 2021 |

| Cost | S$97 for the comprehensive bronze plan. Do check out the website for customisation based on age and destination. |

Find a travel insurance plan that suits you with their comprehensive bronze, silver and platinum plans. Allianz’s travel insurance is catered to different needs, for frequent travellers, one-off trips and also family coverage that comes with affordable premiums.

8. Income’s Travel Insurance

| Type of Information | Details |

| Website | https://www.income.com.sg/travel-insurance |

| Coverage and Benefits | – Personal accident – Medical expenses overseas – Trip cancellation – Loss/damage to personal belongings |

| COVID-19 Cover Add-On | COVID-19 benefits + PCR test at $124.20 |

| Cost | S$52.68 for Classic plan. Do check out the website for customisation based on age and destination. |

Income Travel Insurance is now running a promotion of 40% off the Classic, Deluxe and Preferred single trip plans with COVID-19 coverage to ensure you get the necessary protection.

One thing we like about them is their Enhanced PreX plans which provides comprehensive coverage for pre-existing injuries and illnesses that you knew about or sought treatment for before your trip.

9. Sompo TravelJoy

| Type of Information | Details |

| Website | https://www.sompo.com.sg/products/traveljoy |

| Coverage and Benefits | – Emergency Medical Evacuation or Repatriation – Travel Delay For All Risk – Trip Disruption Cover – $100 ticketed cancellation for un-utilised paid event ticket – Personal Accident Protection – Local and Overseas Medical Expenses |

| COVID-19 Cover Add-On | TravelCovid |

| Cost | S$71 for Deluxe plan. Do check out the website for customisation based on age and destination. |

If you’re travelling to Japan, Sompo’s TravelJoy insurance may be the most suited one as they offer Japan specific coverage. Their Go Japan! plan is specially tailored plan for travellers to Japan, covering cashless services at 740 clinics and hospitals.

Furthermore, they also provide free over the phone translation services while you’re in Japan for your holiday. We also like their trip distribution cover of $100 which covers un-utilised paid event tickets to theme parks or concerts etc.

10. Great Eastern TravelSmart Premier

| Type of Information | Details |

| Website | https://www.greateasternlife.com/sg/en/personal-insurance/our-products/travel-insurance.html |

| Coverage and Benefits | – Extensive medical coverage (Dental, TCM, Chiropractor treatments) – Comprehensive protection worldwide – 24-hour international emergency assistance services including up to $1 million coverage for emergency medical evacuation – Complimentary benefits at no extra premium – Take part in extreme sports knowing you are covered at no additional premium |

| COVID-19 Cover Add-On | With no additional premium needed, get up to $150,000 coverage expenses and emergency medical evacuation if you are diagnosed with COVID-19 during your Vaccinated Travel Lane (VTL) trip |

| Cost | Classic plan for S$83 per traveller. Do check out the website for customisation based on age and destination. |

Great Eastern’s TravelSmart Premier allows you to head on your VTL trip with a peace of mind, with no additional premium. We like them for their COVID-19 coverage that covers you for COVID-19 related conditions during your trip.

They also offer a range of plans of which you can choose from – TravelSmart Premier Basic, Classic and Elite Plans of which you can choose one based on your travel needs.

In support of Singapore’s COVID-19 vaccination efforts, enjoy a premium discount for Elite and Classic plans if you have been fully vaccinated against COVID-19. Indeed one of our top travel insurance in Singapore!

Conclusion

Do you have any reviews and comments to share regarding our choices for the best travel insurance in Singapore for that next flight out of Singapore?

While SBO is committed to supporting our local businesses, we welcome any feedback and anonymous sharing regarding your experience with the above-listed best travel insurance in Singapore.

We hope that this guide will be useful in helping you to make a better decision when it comes to finding the best travel insurance in Singapore.

Explore More Content

Table of Content