9 Best Car Insurance in Singapore that are Popular Among Car Owners [2025]

Gotten a new car and not sure which car insurance to choose? We have compiled for you a list of the 10 best car insurance in Singapore to make sure you and your loved ones feel safe and secure.

We all know buying a car can be expensive in Singapore and so it is very important that we insure our car and get comprehensive coverage. Not only so, getting a car insurance can give you and your loved ones a peace of mind, knowing that you will be protected in unforeseen and unfortunate circumstances.

Therefore, as car owners, you have to choose the right car insurance that best fit the needs of you and your loved ones. We know that with so many car insurance policies in the market, it can be really daunting to make a choice, especially for first-time car owners.

As such, we compiled together a simple and comprehensive list of the 10 best car insurance in Singapore to make sure you and your loved ones feel safe and secure while driving.

1. FWD Car Insurance

| Type of information | Details |

| Website | https://www.fwd.com.sg/car-insurance/ |

| Highlights to Note | – Good value for money, has Lifetime NCD guarantee – No need to name all drivers. Anyone you trust to drive your car is insured (not applicable for Classic Plan) – Receive up to S$80 daily transport allowance (for up to 10 days) when your car is being repaired |

| Address | 6 Temasek Blvd, #18-01 Suntec Tower Four Singapore 038986 |

| Contact Details | Tel: +65 6820 8888 |

| Operating Hours | Monday – Friday 9:00am – 6:00pm (Excluding Public Holidays) |

| Online Reviews | 4.6/5.0 – TrustPilot |

FWD is a fully digital insurer, who places a lot of priority and focus in being extremely user-friendly, providing you with a hassle-free customer experience. You can rest assured that you will get a quote and purchase your car insurance plan on their website within minutes.

A great point about FWD car insurance is that it is relatively flexible where FWD’s coverage can extend to anyone you trust to drive your car. T&Cs apply. You can opt to pay for your car insurance in instalments with a DBS/POSB Mastercard or Visa Credit Card.

2. Budget Direct Comprehensive

| Type of information | Details |

| Website | https://www.budgetdirect.com.sg/car-insurance |

| Highlights to Note | – Some of the cheapest policies on the market – Can customize coverage to only pay for what you need – Covers cars up to 15 years old – Young/inexperienced driver excess is only S$500 |

| Address | 190 Clemenceau Avenue, #03-01 Singapore Shopping Centre Singapore 239924 |

| Contact Details | Email: [email protected] Tel: 65 6221 2111 |

| Operating Hours | Monday – Friday 8:00am – 8:00pm Saturday 9:00am – 3:00pm (Excluding public holidays) |

| Online Reviews | 4.6/5.0 – Feefo |

Next on the list of the 10 best car insurance in Singapore is Budget Direct, which offers some of the cheapest policies on the market. With its unbeatable premiums of almost 55% below average regardless of gender and NCD, Budget Direct would be a great fit for drivers whose priority is to minimize their costs.

It will also be a great fit for low-risk, experienced drivers who do not mind having car insurance policies with only the bare essentials.

Budget Direct is currently having a promotion now – Use promo code “AUTODAD” for S$100 NETS FlashPay, use Affinity ID “VALUE5” for 5% off. T&Cs apply.

3. AIG Car Insurance

| Type of information | Details |

| Website | https://www.aig.sg/personal/car-insurance |

| Highlights to Note | – Cover for own damage in a vehicle collision – Cover for fire in a vehicle collision – Cover for third-party property damage – Unlimited cover for third-party bodily hurt |

| Address | AIG Building, 78 Shenton Way, Level 1 Singapore 079120 |

| Contact Details | Tel: +65 6419 3000 |

| Operating Hours | Monday – Friday 9am – 5pm Saturday – Sunday Closed |

AIG Car Insurance offers a collision-only cover that helps you to save more while on the road. As most car insurance claims involve accidents with other vehicles, a AIG Car Insurance Collision-Only plan may be all you and your loved ones really need.

AIG Car Insurance Collision-Only plan is an auto insurance plan that covers damages or losses to your car, resulting from a collision with another vehicle. The plan also includes third-party liability cover for bodily injury and property damage.

Therefore, if you are a safe driver with lots of experience, AIG Car Insurance may just be the right car insurance plan for you.

4. NTUC Income Car Insurance — Drivo

| Type of information | Details |

| Website | https://www.income.com.sg/drivo-car-insurance |

| Highlights to Note | – Reputable brand with excellent roadside assistance, with Orange Force riders arriving at accident scenes to provide help anytime and anywhere – 30+ authorized workshops island wide – Discount schemes for safe driving and driving less– Mobile app designed to reduce reporting hassle for minor accidents |

| Contact Details | https://www.income.com.sg/contact-us |

| Online Reviews | 4.2/5.0 – ValueChampion |

As one of the most popular car insurance in Singapore, NTUC Income Car Insurance Drivo is well-known for its emergency assistance team, Orange Force, who will come to the accident scene to arrange for medical help, vehicle removal, and help you sort out the insurance claim.

This helps the drivers solve a huge pain point in times of accidents as they may have no idea where to begin after getting into an accident.

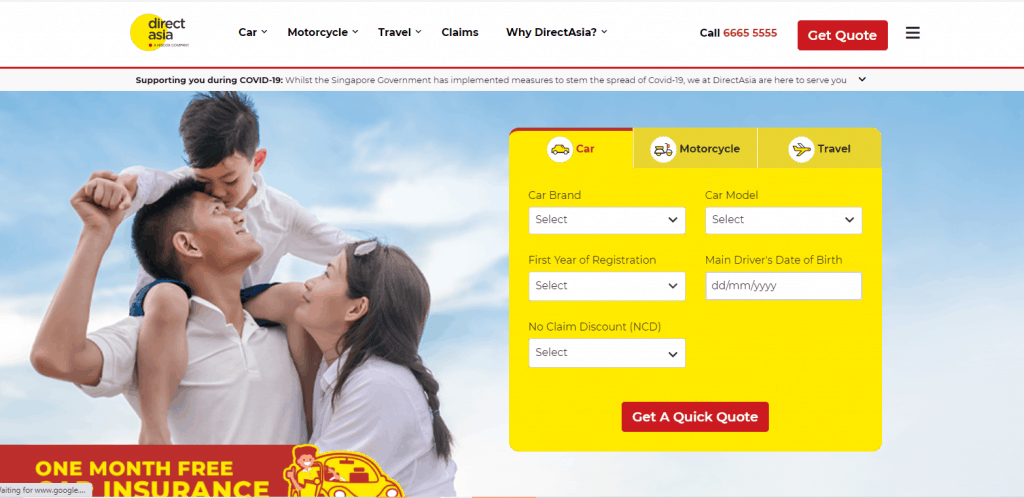

5. DirectAsia Car Insurance

| Type of information | Details |

| Website | https://www.directasia.com/car-insurance |

| Highlights to Note | – Benefits are great for luxury car owners & families – Highly customisable – 10% discount if you insure 2nd car – One of the cheapest options for luxury car owners |

| Address | 20 Anson Road, #08-01, Singapore 079912 |

| Contact Details | Tel: +65 6665 5555 |

| Operating Hours | Monday – Friday: 8:00am – 6:00pm (by appointment only) |

| Online Reviews | 4.2/5.0 – ValueChampion |

If you are driving a luxury car, DirectAsia’s Comprehensive car insurance plan may be a good fit for you as it is one of the cheapest options for luxury car drivers. This is because Direct Asia’s Comprehensive car insurance in Singapore has the flexibility of customising their coverage. Customers can have a high level of control over which features they want to include in their plan and how much coverage they want.

DirectAsia is currently having a promotion now – Enter code ‘YECAR200’ and get $200 CapitaVouchers. Up to S$100 of Shell Fuel + 24-Hour Free Breakdown Assistance. T&Cs apply.

6. Etiqa (Tiq) Car Insurance

| Type of information | Details |

| Website | https://www.tiq.com.sg/ |

| Highlights to Note | – Easy to buy and claim (claims can be paid out in 30 minutes) – S$50/day allowance if your car is stuck in workshop – Adjustable excess for better pricing – Low age limit (24) for young & inexperienced driver – Affordable premiums thanks to ongoing promos |

| Address | 16 Raffles Quay, Hong Leong Building, #01-04A, Singapore 048581 |

| Contact Details | Email: [email protected] Tel: +65 6887 8777 |

| Operating Hours | Monday – Friday 8:45am – 5:30pm (Excluding Public Holidays) |

| Online Reviews | 4.4/5.0 – Feefo |

Next on the list of the best car insurance in Singapore is Etiqa (also known as Tiq), who prides itself as a fast and convenient digital insurer.

All you need to do is to submit your repair claim of up to S$5,000 online (only applicable for ‘own damage’ claims), and Etiqa can verify and pay it out in as fast as 30 minutes. Amazing, isn’t it?

7. Great Eastern Car Insurance – Drive and Save Plus

| Type of information | Details |

| Website | https://www.greateasternlife.com/sg/en/personal-insurance/our-products/car-insurance/drive-and-save-plus.html |

| Highlights to Note | – Choice of workshop and waiver of excess – High coverage and medical expense reimbursement – 24/7 accident assistance – Additional premium savings for safe drivers |

| Address | 1 Pickering Street #01-01 Great Eastern Centre Singapore 048659 |

| Contact Details | Tel: +65 6248 2211 |

| Operating Hours | Mondays – Fridays: 9:00am – 5:30pm (Excluding Public Holidays) |

With Great Eastern’s Drive and Save Plus Car Insurance Plan, customers will get to enjoy hassle-free claims processing and quality car repair services at your workshop of choice in the event of an accident. The plan offers one of the highest personal accident coverage in the market, of up to S$120,000 and medical reimbursement for both driver and passengers.

There will also be a 24/7 towing assistance in case of accidents anywhere in Singapore, West Malaysia and Thailand. With Great Eastern’s Drive and Save Plus car insurance plan, you can be assured that you and your loved ones can drive to anywhere safe and secure.

8. HL Assurance Comprehensive

| Type of information | Details |

| Website | https://www.hlas.com.sg/ |

| Highlights to Note | – Competitively priced – One of the highest 50% NCD discounts – Provides great value for experienced drivers |

| Address | 11 Keppel Road #11-01 ABI Plaza Singapore 089057 |

| Contact Details | Tel: +65 6702 0202 |

| Operating Hours | Mondays – Fridays: 9:00am – 6:00pm (Excluding Public Holidays) |

| Online Reviews | 4.0/5.0 – ValueChampion |

HL Assurance Comprehensive car insurance in Singapore would provide great value for safe drivers with plenty of driving experience. To purchase HL Assurance Comprehensive, you will need to be between the age of 27 and 65. Young or inexperienced drivers will have to pay a higher excess of S$3,000.

Therefore, with its restrictive age limits for policy purchase and high inexperienced YIDR, HL Assurance Comprehensive will only provide great value for more experienced drivers.

If you are interested in purchasing HL Assurance Comprehensive, you can get to enjoy 25% off and free car servicing. So wait no further and grab one now!

9. MSIG Car Insurance — MotorMax

| Type of information | Details |

| Website | https://www.msig.com.sg/ |

| Highlights to Note | – Reputable brand with 30+ authorized workshops – Offers car loan protection of S$100,000 in the event of death (for MotorMax Plus policy only) |

| Address | 4 Shenton Way #21‑01 SGX Centre 2 Singapore 068807 |

| Contact Details | Tel: +65 6827 7602 |

| Operating Hours | Monday – Friday 8:45am – 5:30pm (Excluding Public Holidays) |

As one of the longer-standing insurance companies for car insurance in Singapore, MSIG is a well known and trusted brand among many. Aside from its solid reputation, MSIG also offers a car loan protection benefit.

This means that in the case where the car owner passes away, MSIG will pay off the remaining car loan so that the surviving family members will not have to worry about the debt. This comes as a huge relief for many as cars in Singapore are so expensive.

Conclusion

Do you have any reviews and comments to share regarding our choices for the best car insurance in Singapore?

While SBO is committed to supporting our local businesses, we welcome any feedback and anonymous sharing regarding your experience with the listed outdoor furniture in Singapore.

We hope that this guide will be useful in helping you to make an informed decision when it comes to finding the best car insurance in Singapore.

Explore More Content

Table of Content