Will Cryptocurrency Replace Fiat Currency?

Will Cryptocurrency replace Fiat Currency? In this article, we seek to do this by analysing the features of both Cryptocurrency and Fiat Currency.

Yes, Bitcoin is officially the buzzword for the 21st century. Paypal Holdings, inc, has just announced that they’re accepting cryptocurrencies. They will be joining some of the big names in the markets, such as Microsoft and Tesla, in this crypto-mania.

Throughout human history, the medium of the transaction has been changing every few centuries. The emergence of cryptocurrencies has taken the world by storm since its inception in 2009.

It may very well revolutionise our conventional ways of monetary transactions – if it were to succeed. The array of cryptocurrencies present, specifically Bitcoin, has become a ubiquitous form of currency as more businesses and individuals accept it as a form of payment.

Despite this, this novel concept has also sparked numerous controversies amongst experts. The high volatility of its markets, coupled with its complexities, makes it difficult for many to comprehend the viability of it as an alternative currency.

Reasons Why Many Remain Optimistic That Cryptocurrencies Can Replace Fiat Currencies

Everybody can agree that 2020 seemed like the most disastrous year in recent times: the whole world was engulfed by the pandemic, and the resulting economic woes triggered by the ongoing US-China trade war were extremely pervasive. So why is it that even amidst the pandemonium that we are facing, consumer confidence in bitcoin has still remained unwavering?

1. Cryptocurrencies are Decentralized and More Transparent than Fiat Currency.

Since the banking system is very much predicated on trust, it could mean that this trust by the general populace is susceptible to abuse by regulators, elite financiers, bankers, and corrupt governments. Nakamoto, the creator of bitcoin, has even said so himself in a 9-page manifesto.

The history of fiat currencies was full of breaches of trust.

Nakamoto, Creator of Bitcoin

On the other hand, blockchain technology will make ‘powerful entities’ relinquish control of financial institutions, and let transactions be handled on a ‘peer-to-peer’ basis. By doing so, consumers like yourself will be relieved to find out that your personal identity will be protected. Furthermore, you will have complete and unprecedented autonomy over your financial plans without the intervention of any third party. The wealthy no longer need to place their wealth in offshore accounts nor the Swiss bank.

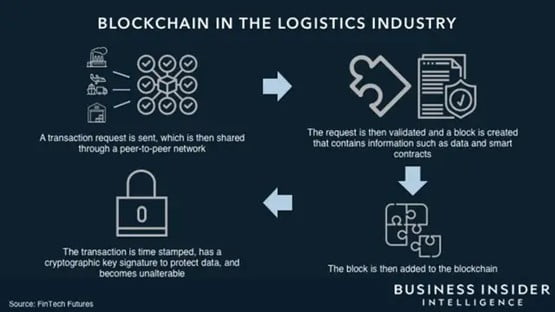

How Blockchain technology oversees this:

Source: Business Insider

Blockchain technology stores the transaction in blocks, which are then linked together in a chain. The ‘block hash’ links the blocks together and prevents any of the boxes from being altered. Each existing block will in turn strengthen the verifications of other blocks. This means that you have to tamper with all blocks not to be discovered, making it very tough to trace your transactions. Furthermore, transactions are encoded by cryptography, which makes it difficult for third parties to reverse engineer the previous inputs.

2. Using Cryptocurrency Can Save Costs and Time for Merchants and Consumers Alike

Merchants have a good reason to dislike the use of credit cards. The processing fees and risks of chargebacks are expenses that outweigh consumer convenience. However, with cryptocurrencies, traditional banking fees no longer apply. Although transaction fees are not completely eliminated, they are certainly much lower as compared to a traditional financial system.

3. Most Importantly, Governments and Businesses are Becoming Increasingly Interested in Cryptocurrencies

Just one month ago, Tesla broke the internet when it decided to purchase a whopping 1.5 billion USD worth of bitcoin. This resulted in consumers being able to use bitcoin as a form of payment for Tesla products. The entrance of big corporations like Paypal is simply a matter of time.

If large business conglomerates were to put their faith in cryptocurrencies, then surely on the premise of herd mentality, hundreds and thousands of merchants would follow suit. Ultimately, the growing mainstream acceptance of cryptocurrencies that allows it to prevail in the end. Ultimately, the mainstream acceptance of cryptocurrencies will no doubt be the true measure of their success.

Why Fiat Currencies Will Still Exist in the Long Term?

Albeit all the hype about bitcoin and cryptocurrencies, there remain many skeptics in regards to this global phenomenon. In fact, one of the most successful value-based investors in the world, Warren Buffet, is confident that “they will come to a bad ending”. Their popularity does not hold true weight in its stages of infancy if it has yet to rear its ugly head.

1. The Volatility of Cryptocurrency Markets Makes it Highly Unrealistic for it to Be Adopted as a National Currency.

One prominent trait of cryptocurrencies is that the markets are extremely volatile. The volatility of prices reached almost 8% over a short span of three months back in 2017.

The problem lies in how unpredictable prices are relative to existing currencies, meaning that large changes in their value will result in the value of all goods and services experiencing frequent fluctuations.

The lack of regulations poses an even bigger problem when price fluctuations spiral out of control. After all, it may end up as another episode of Tulipmania, plunging into a bottomless chasm. As of now, there is still a lack of widespread adoption of cryptocurrencies as a form of payment – in stark comparison with the USD.

2. The Absence of Third Parties, Especially Regulatory Bodies with Authority, May Engender Unscrupulous Behaviour.

Quoting the author of Leviathan, Thomas Hobbes is probably right when it comes to a strong rule of law and punishments to keep us in check. Indeed, our lives will certainly be “nasty, brutish, and short” if hackers take advantage of the lack of regulators, and exploit this new medium for personal gains.

Illegal activities such as the sale of drugs, firearms, and human trafficking will become the new norm. There’s nothing anyone can do to rectify it as transactions remain a secret between the merchant and the consumer.

As such, government regulations are inevitable. Already, the Indian government is in the midst of proposing a ban on cryptocurrencies, penalising miners and traders. The Chinese government wants a decentralized ledger operating under a centralized authority. This is probably why they are now experimenting with the e-Yuan, in hopes that it can compete with Bitcoin.

So What is the Future of Cryptocurrencies?

Source: Entrepreneur

Undoubtedly, there will be existing frameworks globally to ensure that consumers remain protected and that financial systems are well maintained. But governments themselves are optimistic about the future of cryptocurrencies and have been actively facilitating the transition towards them. Closer to home, Singapore’s state fund, Temasek Holdings, has already given the green light. Vertex Ventures have already invested in Binance to enable cryptocurrencies’ conversion into SGD.

Ultimately, the success of cryptocurrencies will depend largely on the global populace. It is a good sign that many are branching out to cryptocurrencies within their investment portfolios – of which there is certainly no harm in doing so.

As history has shown us time and again, it could take years, even decades, before cryptocurrencies can exit their infant stage. Time is needed for financial intermediaries to adapt to the changing circumstances – and most importantly for investors and people all over the world to understand the complexities. Only then will cryptocurrencies progress from a nascent idea to a primary medium of exchange for future generations.

Featured Image by Executium on Unsplash

Explore More Content

Table of Content