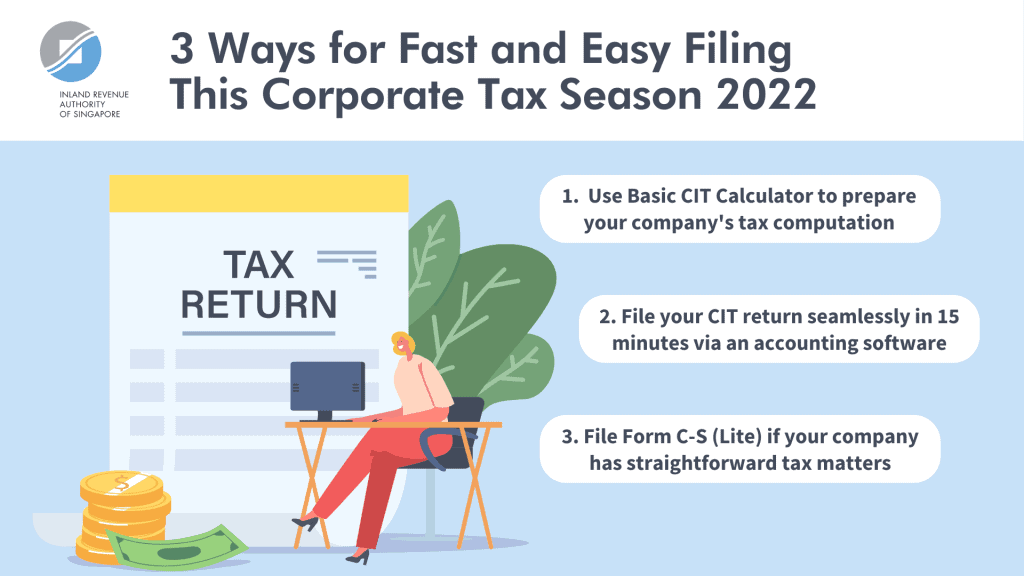

3 Ways for Fast and Easy Filing This Corporate Tax Season 2022

Corporate Income Tax (CIT) filing deadline is around the corner – all companies will need to file their CIT Returns...

Corporate Income Tax (CIT) filing deadline is around the corner – all companies will need to file their CIT Returns (Form C-S/ Form C-S (Lite)/ Form C) for the Year of Assessment (YA) 2022 by 30 November 2022. If you are just getting started, the Inland Revenue Authority of Singapore (IRAS) has 3 suggestions for you to enjoy a fuss-free tax filing experience this season.

Use Basic CIT Calculator to prepare your company’s tax computation

Before jumping straight into filing your CIT tax return, you should first prepare your company’s tax computation and supporting tax schedules to ensure you report the right figures. A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax. Tax adjustments can include non-deductible expenses, non-taxable income, and capital allowances.

Not sure where to start? Try out the Basic CIT Calculator available on the IRAS website, which provides explanatory notes to guide you through your tax computations and validation checks against common errors.

File your CIT return seamlessly in 15 minutes via an accounting software

Wished that you could complete your CIT filing in just 15 minutes, hassle-free? You can, by simply adopting an accounting software with seamless filing capability! Companies with annual revenue of $5 million or below and meets the qualifying conditions will be eligible to prepare and file Form C-S directly to IRAS through the software at the click of a button.

Not only can seamless filing save up to 95% of your time needed to prepare and file Form C-S, it also improves the accuracy of your CIT Return by reducing potential transposition errors through eliminating the need for manual data entry in myTax Portal. On top of that, digitising your company’s financial records through an accounting software can make book-keeping less tedious, while ensuring that you have convenient access to essential information required to make effective business decisions. The benefits of adopting such an accounting software are aplenty, and there are also government support schemes available to kick-start your journey.

Interested? Check out the list of accounting software that enable taxpayers to fulfil their tax obligations seamlessly and the available government grants on IRAS’ website.

File Form C-S (Lite) if your company has straightforward tax matters

Give Form C-S (Lite) a try this tax season, if your company’s annual revenue is $200,000 or below, and meets the qualifying conditions to file Form C-S. Form C-S (Lite) is a simplified version of Form C-S that requires only 6 essential fields to be completed by companies with straightforward tax matters.

Like Form C-S, your company will not be required to submit its financial statements and tax computation. However, your company should still prepare these documents and be ready to submit them upon IRAS’ request.

Looking for Digital Resources on CIT Filing?

For a quick crash course on CIT filing, be sure to check out IRAS’ playlist of comprehensive CIT e-Learning videos. Topics covered range from the CIT filing obligations of a company to basic CIT rules such as taxability of income and deductibility of expenses. With the e-Learning videos that are available around the clock, you can enjoy the convenience of learning at your own pace anytime, anywhere.

Now that you are all set, remember to file your CIT Return (Form C-S/ Form C-S (Lite)/ Form C) by 30 November 2022. All directors are reminded to ensure that their companies’ tax returns are filed on time. Companies are also encouraged to opt for IRAS’ digital notices. To receive timely e-Notifications from IRAS, please update your email address(es) and notification preference via the “Update Notice Preferences” digital service at myTax Portal.

If your company needs further assistance on the YA 2022 tax filing, you can visit the IRAS website, contact IRAS via myTax Mail, or call the helpline at 1800 356 8622.

Explore More Content

Table of Content