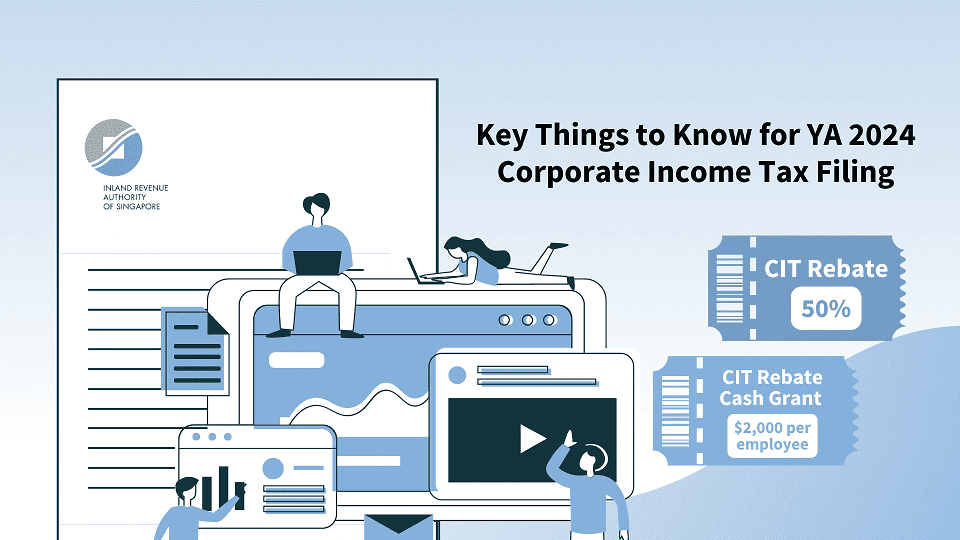

YA 2024 Corporate Income Tax Filing At A Glance: A 3-Min Guide to Tax Rebate, Seamless Filing and More

Filing your company’s tax return this year comes with some exciting incentives that could significantly impact your bottom line. The Inland Revenue Authority of Singapore (IRAS) breaks down the key points you need to know.