20 Best Accounting Software in Singapore to Balance Your Ledgers Quick and Easy [2026]

Look for the best accounting software that can help you to balance your ledgers quick and easy.

Accounting software is a type of Customer Relationship Management (CRM) tool which allows business owners of all sizes to better manage their accounts. Based on your business need, there are different accounting software out there in the market to service your business need.

An accounting software definitely helps generate time and cost savings by instantly generating key financial reports, streamlines tax filing and also provides key insights amongst many of its key functionalities.

We’ve shortlisted 20 of the best accounting software in Singapore for business owners today. Here’s how to pick one to best suited to your business needs!

Factors to Consider Before You Choose an Accounting Software

Before you make a decision on an accounting software, there are a few important factors to consider. Take heed to these factors.

1. What Kind of Features Does the Software Have?

Choosing a software with the right features is of paramount importance – depending on the needs of your firm, some features might be super important like payroll while others might not be as important. When looking at features and functionalities, it is also important to keep in mind your future business needs – would the current functionalities be sufficient when you scale up your business?

- Vendor payments and reports

- Ability to track expenses and income

- Credit card payments

- Ability to invoice customers

- Bank reconciliation

2. What Kind of Customer Service Support Can You Get?

Customer service support is important – especially for new users of the software. Even if it is not one’s first time using an accounting software, the learning curve for a new software can be equally as steep.

Read blog posts on customer reviews, head to the company’s site to find out the type of support they provide. Some even have 24-hour hotlines to service their customer’s needs.

3. How accessible is the software?

Is the software available while you’re on the go? Is there the option of accessing the software from multiple devices?

If you have multiple team members needing to access the software at the same time, can the software support this? This would greatly help facilitate processes and would be good to do your due diligence in case you select the wrong software.

1. Ace Accounts

| Type of Information | Details |

| Website | https://www.acesoft.com.sg/ |

| Features | – Mobile-based, Cloud computing – No accounting settings required – Convenient data entry using phone camera (AI-powered OCR technology) – All-in-one (Accounting, HR, Inventory, reminders, etc) |

| Best For | Small businesses, Freelancers, Self-employed |

| Estimated Price Points | Ace Accounts’ starting plan start from NETT $16.98 SGD / month ($168.98 for annual plan) |

| Online Reviews | 139 GetApp Reviews (Average rating: 4.5/5.0) |

The first mobile-based “on-the-go” accounting software designed by a Singapore Tech start-up. Ace Accounts is different from other traditional accounting softwares: they are super easy to use and well-designed with a revolutionary interface meant for users even without accounting experience

Firstly, NO accounting settings are required – just input data using your mobile phone, and the rest are automated by the mobile app. Comprehensive reporting compliant with IRAS, including GST reports and accounting reports, are just a click away!

Secondly, Ace Accounts simplifies the data entry process by using AI-powered OCR text extraction technology to convert physical documents into digital data. All you need is a phone with a camera to take pictures of your documents and receipts. They’re then stored as digital files for record keeping.

Lastly, Ace Accounts is an all-in-one cloud software solution. Besides the Accounting and Bookkeeping feature, there are additional functional modules integrated, like HR Module (Payroll, Leave, and Claim Management), Inventory Management, etc. Also available for all plans are other super convenient features such as Push notification to remind you of all important dates and deadlines, as well as the Smart Virtual Assistant to help you with your questions 24/7.

2. Xero

| Type of Information | Details |

| Website | https://www.xero.com/sg/ |

| Features | – Bank connections – Multi-currency accounting |

| Best For | Small businesses |

| Estimated Price Points | Xero’s starter package starts from $33 SGD a month (totals to $396 SGD a year), with multiple add on options. |

| Online Reviews | 157 Google Reviews (Average rating: 4.8/5.0) |

Often being dubbed as one of the most popular cloud based accounting softwares in Singapore, Xero truly lives up to its name. With a whopping 1.82 million users worldwide, it is no doubt Xero is one of the market leaders.

One of the unique selling points is that it has various packages catered for businesses in different stages of development (new, growing, established), making it all the more versatile for clients to onboard Xero. Unique to Xero is also its currency conversion feature which automatically converts the currency for you.

3. Sage

| Type of Information | Details |

| Website | https://www.sage.com/en-sg/ |

| Features | Small Businesses – Sage UBS – Sage Payroll Medium Businesses – Sage 300 Solutions – Sage X3 |

| Best For | Small Businesses |

| Estimated Price Points | Sage Accounting’s Business Cloud Accounting pricing starts at USD$12.00 per month ($144 USD/ year). They do not have a free version. |

| Online Reviews | 51 g2 Reviews (Average rating: 4.3/5.0) |

With dedicated solutions for small and medium enterprises – Sage UBS for small businesses and Sage 300 solutions for medium enterprises, we see the emphasis that Sage places on catering to specific needs. Sage’s solutions fit the needs of startup, scale-up, and enterprise companies, providing quality solutions for integrated accounting, payroll and payment systems.

Sage UBS, the accounting software in Singapore dedicated to small businesses boosts a wide range of connected services – one can create alerts, messages, or chat with the help desk to solve issues. With their outstanding software and customer centricity, they were the 2019 and 2020 top financial accounting software vendor in Malaysia.

4. ABSS

| Type of Information | Details |

| Website | https://sg.abssasia.com/abss-accounting |

| Features | – DBS Bank Feeds – InvoiceNow |

| Best For | Owner Operators |

| Estimated Price Points | Basic package for 1 user starts from $424 SGD, including free installation, database setup and free 30 days support. |

| Online Reviews | 3 Facebook Reviews (Average rating: 5.0/5.0) |

Ideal for owner-operators, ABSS Accounting helps one process sales and purchases, track receivables, payables and GST at the tip of one’s fingers.

ABSS Accounting is easy to use for beginners without much accounting background. One convenient feature is that of the ability to connect the DBS account securely with ABSS Connect where your bank account and transaction data is delivered securely and accurately to your ABSS accounting software.

5. Intuit QuickBooks Online

| Type of Information | Details |

| Website | https://quickbooks.intuit.com/sg/ |

| Features | – Cloud accounting – Customized invoices and quotes |

| Best For | Small businesses |

| Estimated Price Points | The most basic package plan – Pro Plus 2021 starts from $199.99 USD per year, with access to the latest features, security patches and automatic data recovery. |

| Online Reviews | 78 G2 Reviews (Average rating: 4.4/5.0) |

Off-the-shelf software, such as QuickBooks, a product offered by Intuit is widely used amongst small business owners. If you are a small and medium sized business owner, here are some reasons you might want to choose QuickBooks. This suite of services would come in handy to service your basic accounting needs, with little accounting experience needed.

Professional support – It is commonplace for business owners to need orientation when using a new software and even more so someone who they can turn to in the case of any difficulties faced. QuickBooks Singapore offers a contact helpline and also boasts a strong user community where users pose questions and help each other out.

6. Smart Cursors

| Type of Information | Details |

| Website | https://smartcursors.com/ |

| Features | – Multi-Currency Platform – Cash Flow Manager |

| Best For | Small and Medium Enterprises (SMEs) and Large Enterprises (LEs) |

| Estimated Price Points | Estimated Price Points: Pricing plans |

| Online Reviews | 158 Media One Marketing Reviews (Average rating: 4.9/5.0) |

Like many others, Smart Cursors helps businesses in managing their accounting needs and business performance.

So what differentiates them from other accounting softwares out in the market? They boast of their cash flow management system where one can manage deposits, withdrawals, transfers and bank reconciliations effortlessly. The interactive Cash Flow Manager gives insights on how the cash have been generated and spent in one glance.

The Invoice Now feature facilitates sending/receiving the e-invoices directly through the open standard Peppol network securely. This helps both Small and Medium Enterprises (SMEs) and Large Enterprises (LEs) enjoy smoother invoicing.

7. Highnix

| Type of Information | Details |

| Website | https://www.highnix.com/ |

| Features | – Highnix Enterprise Resource Planning (ERP) – Enhanced Inventory and Sales Management – Peppol E-invoice |

| Best For | SMEs, micro enterprises and new start ups |

| Estimated Price Points | SaaS License starts from $90 per month, inventory management starts at $120 per month. Both come with a 6 months subscription waiver. |

| Online Reviews | 158 MediaOne Marketing Reviews (Average rating: 4.9/5.0) |

Highnix believes in productivity tools, to generate productivity and ease of software use for SMEs, micro enterprises and new start ups.

The Highnix accounting system is secure – it boasts X.509 encryption and third party’s applications can be integrated with Highnix ERP System using appropriate APIs, allowing for scalability of the business in the case of future expansion.

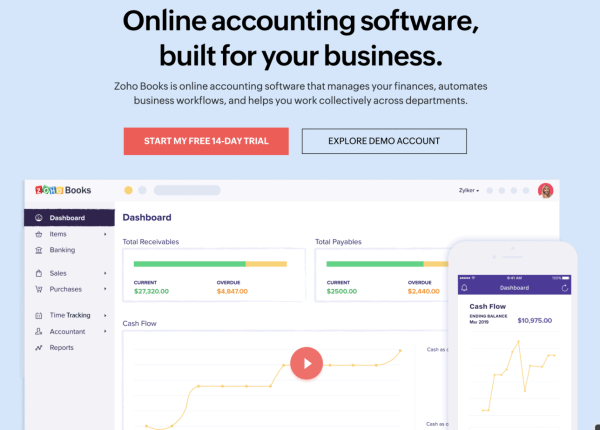

8. Zoho Books

| Type of Information | Details |

| Website | https://www.zoho.com/books/ |

| Features | – Third Party Integrations – End-to-end accounting – Customizable Invoice |

| Best For | Variety of business sizes |

| Estimated Price Points | Zoho is free for businesses with less than 50K USD of turn over per annum. Their standard package starts from $10 USD per organization / month ($120 per annum), billed annually. |

| Online Reviews | 90 g2 Reviews (Average rating: 4.5/5.0) |

India-based SaaS company Zoho Corporation offers Zoho Books as part of its Zoho One Suite offerings. Zoho Books like many others in the industry is an online accounting software that helps in financial and business management. Zoho is an ideal fit for a variety of business sizes, robust even for larger enterprises.

What sets Zoho Books apart from its competitors is firstly its myriad of third party integration capabilities – Paypal, Dropbox, OneDrive and Square just to name a few of its many integration capabilities. With Zoho, you’ll be able to create unlimited transactions and add any number of users.

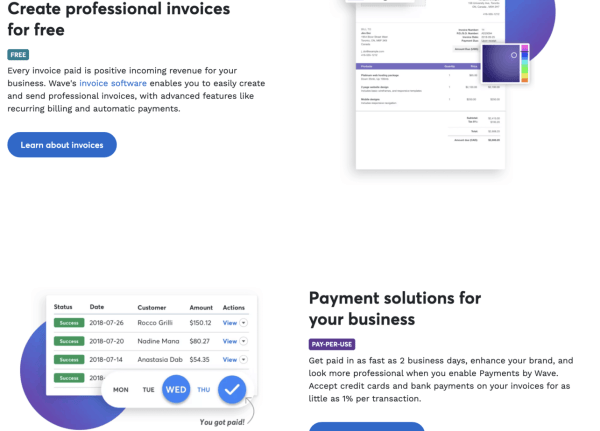

9. Wave

| Type of Information | Details |

| Website | https://www.waveapps.com/ |

| Features | – Customizable Invoice Software – Wave Payments Network – One-Stop Accounting System |

| Best For | Entrepreneurs, SMEs |

| Estimated Price Points | Estimated Price Points: Pricing plans |

| Online Reviews | 1197 SoftwareAdvice Reviews (Average rating: 4.4/5.0) |

Hearing that Wave software is free of charge raises eyebrows. There are indeed no hidden costs and the software is 100% free, no trials, no limitations.

The free software includes invoicing, accounting, and receipt scanning. Wave’s easy-to-use accounting software’s ability to be connected to bank accounts, expenses syncing and balancing the books are just some of its many capabilities.

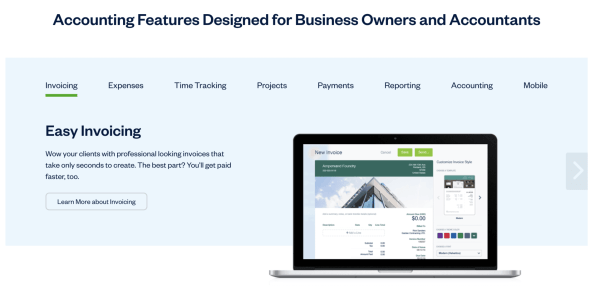

10. Freshbooks

| Type of Information | Details |

| Website | https://www.freshbooks.com/ |

| Features | Credit feature to track prepayments, overpayments and credit notes |

| Best For | Freelancers, Businesses with employees, Businesses with contractors |

| Estimated Price Points | Their Lite plan starts from $139.50 USD per year but only services 5 billable clients. The most popular Plus plan starts from $232.50 per annum with a huge increase to 50 billable clients. These plans also offer free trials so try if out if you are still unsure! |

| Online Reviews | 643 g2 Reviews (Average rating: 4.5/5.0) |

Freshbooks is one of the most suitable accounting software in Singapore for freelancers to businesses with a whole range of clients.

One of the most touted pros by users of Freshbooks was that the software is very user friendly and intuitive. Praises also mostly surrounded that of the invoice feature which is not only professional looking but the entire system is hosted on a cloud, ensuring that client’s information are secured.

11. Netsuite

| Type of Information | Details |

| Website | https://www.netsuite.com.sg/portal/sg/products/erp/financial-management.shtml |

| Features | – Integration with Netsuite products – CRM, E-Commerce – Revenue Recognition Management Solution – Billing Management |

| Best For | Mid-Sized Businesses |

| Estimated Price Points | Its base license costs $999 per month with access costs of $99 per user, per month. The NetSuite license operates as a subscription model and may be renewed annually or over longer intervals. |

| Online Reviews | 811 SoftwareAdvice Reviews (Average rating: 4.0/5.0) |

If you have not heard of NetSuite, you would have definitely heard of Oracle. NetSuite is an Oracle product, one of Singapore’s leading web-based business software. NetSuite’s financial management solution is used by thousands of organisations to manage their accounting needs.

With real-time access to live financial data, one can quickly drill into details to quickly resolve delays and generate statements that comply with multiple regulatory financial compliance requirements such as IFRS, GAAP, SOX and others.

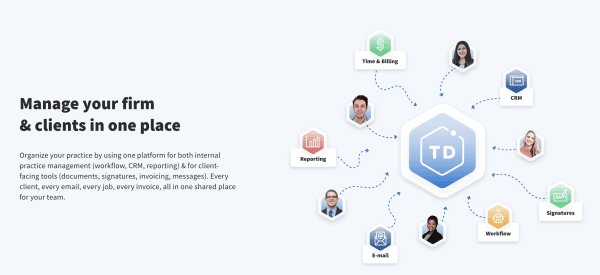

12. Taxdome

| Type of Information | Details |

| Website | https://taxdome.com/ |

| Features | – Personalized support and screen-sharing onboarding sessions at no extra cost for all clients and trial users – Weekly new feature releases |

| Best For | Businesses of varying sizes |

| Estimated Price Points | TaxDome lite from USD$25 per month |

| Online Reviews | 2083 getapp Reviews (Average rating: 4.7/5.0) |

TaxDome is an all-in-one cloud-based solution for tax practice management. Managers can utilize built-in templates to handle tax returns, bookkeeping, payroll, and other accounting processes.

We also like them for the fact that they have a custom branded client portal (& mobile app) where one can communicate with their clients securely, exchange documents, view their tasks, sign contracts, pay invoices, and many more.

13. Odoo

| Type of Information | Details |

| Website | https://www.odoo.com/app/accounting |

| Features | – Smart reconciliation tool – Invoicing: professional invoices, manage recurring billings, and easily track payments |

| Best For | Medium sized enterprises |

| Estimated Price Points | US$ 490.00 for a learning package |

| Online Reviews | 51 g2 Reviews (Average rating: 4.3/5.0) |

Odoo is an open-source alternative to many software packages. It can be used by any retailer with its POS (Point Of Sales), and on any website with its CMS (website builder) synchronized with the e-Commerce app.

They have a strong support community comprising of more than 1,500 active members and has contributed more than 4,500 modules to the ongoing enrichment of Odoo.

14. Aspire

| Type of Information | Details |

| Website | https://aspireapp.com/integrations |

| Features | – Advanced expense and receipt pass throughs – Integrated invoicing and reconciliation – Intelligent categorisation and automated general ledger mapping |

| Best For | Medium to large enterprises |

| Estimated Price Points | $1,000 per month |

| Online Reviews | 8 Facebook Reviews (Average rating: 5.0/5.0) |

Aspire is a cloud-based business management solution that provides features such as estimating, scheduling, purchasing, mobile time tracking, invoicing, job costing, accounting and payroll integration, and customer relationship management (CRM) within its product.

With direct Xero and Quickbooks integrations with hourly updates, it saves lots of time in the accounting process.

15. Financio

| Type of Information | Details |

| Website | https://financio.co/singapore |

| Features | – Bank integration – Dashboard charts and reports – Recurring invoice |

| Best For | SMEs |

| Estimated Price Points | $15/month |

| Online Reviews | 2 Capterra Reviews (Average rating: 4.5/5.0) |

Financio is an IRAS-approved multilingual cloud accounting software. Some Singapore specific features are IRAS Compliant GST and IAF report, Multilingual Interface, Whatsapp Notification and Corporate Paynow.

We like them for the fact that one can connect their DBS bank account to Financio to receive daily bank feeds and reconcile transactions.

16. Tally Accounting

| Type of Information | Details |

| Website | https://www.tally.com.sg/ |

| Features | – Accounting without CODES – Unified Ledgers |

| Best For | Businesses of varying sizes |

| Estimated Price Points | TallyPrime Silver S$900 |

| Online Reviews | 139 SoftwareAdvice Reviews (Average rating: 4.5/5.0) |

The Tally software offers a range of accounting features that instantly allows you to obtain your balance sheets, profit & loss statements, cash and funds flows, trial balances. It also has scenario management capabilities where one can prepare reports that include provisional figures, without affecting actual accounts.

17. Zipbooks

| Type of Information | Details |

| Website | https://zipbooks.com/ |

| Features | – Smart features: ZipBooks Business Health Score, Invoice Quality Score |

| Best For | Businesses of varying sizes |

| Estimated Price Points | Free starter package and $15/month for the smarter package and $35/month for the sophisticated package |

| Online Reviews | 96 SoftwareAdvice Reviews (Average rating: 4.5/5.0) |

User interface screams clean and it is this software with user friendly interfaces that appeal more to users. Zipbooks allows for the connecting of bank accounts, bank statements to be reconciled, and accounting reports to be created.

Application and business systems like Slack, Google Chrome, Google Drive, Google Apps, and Asana also seamlessly integrate with the software.

18. Plooto

| Type of Information | Details |

| Website | https://www.plooto.com/ |

| Features | – Plooto Capture: integrated invoice processing and management, automates the way you manage your invoices and payments – International payment service |

| Best For | Small businesses |

| Estimated Price Points | $25 a month for the subscription fee plus applicable transactional fees |

| Online Reviews | 215 SoftwareAdvice Reviews (Average rating: 4.4/5.0) |

With Plooto’s accounts payable and receivable software, spend more time on growing your business, and less on managing your payments. We like the fact that setting up credit cards on Plooto is easy, and at the same time, enjoy a competitive, straightforward rate of 2.9% + $0.30 per transaction with the benefits of automating your payments process.

19. Autocount

| Type of Information | Details |

| Website | https://autocountsoft.com.sg/ |

| Features | – AutoCount Cloud Payroll – AutoCount Accounting – AutoCount Point of Sale |

| Best For | Businesses of varying sizes – Mid Size Business, Small Business, Enterprise, Freelance, Nonprofit, and Government |

| Estimated Price Points | $17/month with a free trial available |

| Online Reviews | 2 g2 Reviews (Average rating: 5.0/5.0) |

AutoCount is touted to be one of the most affordable cloud-based Payroll with HR elements in the market. This Malaysian accounting software company has more than 25 years software development experience and provides training in the form of documentation, live online, webinars, in person, and videos.

20. Melio

| Type of Information | Details |

| Website | https://www.meliopayments.com/ |

| Features | – Pay vendor bills using bank transfer or debit card for free – Use your credit card where cards are not accepted to hold onto your cash longer and earn card rewards |

| Best For | Small businesses |

| Estimated Price Points | Free for basic features, 2.9% fee for credit card payments |

| Online Reviews | 126 SoftwareAdvice Reviews (Average rating: 4.0/5.0) |

Melio is a free vendor/bill payment tool that maximizes cash flow and minimizes busywork. It also automatically syncs with your QuickBooks and even mails checks on your behalf to vendors so you don’t need to cut checks anymore.

Melio also allows one to schedule payments in advance to go out exactly when they should, save time and better manage clients’ cash-flow.

Conclusion

Do you have any reviews and comments to share regarding our choices for the best accounting software in Singapore?

While SBO is committed to supporting our local businesses, we welcome any feedback and anonymous sharing regarding your experience with accounting software in Singapore.

We hope that this guide will be useful in helping you to make an informed decision when it comes to finding the best accounting software in Singapore!

Explore More Content

Table of Content