Employer CPF Contribution – Guide for Small Business Owners

Learn more about Employer CPF Contribution and how you can optimise the process.

Running a small business from the ground up is extremely taxing work. As the owner, you are probably overwhelmed with growing your business and running day-to-day operations.

In spite of this, small business owners often double up as the ones handling CPF contributions. It is simply not financially sound to hire a dedicated employee to deal with it.

Which employees are entitled to CPF? What is the employer CPF contribution rate? How to calculate employer CPF contribution? How to calculate SDL? What about contributions to community self-help groups?

These questions cause needless worry for small business owners – many of whom already have a lot on their minds.

Dealing with CPF Contributions does not need to be a struggle. To help ease your pains, we at SBO will be answering some frequently asked questions regarding the topic. We will also be sharing some tips and tools that you can use to optimise your CPF processes.

Which Employees are Entitled to CPF Contribution?

Nationality | |

Entitled | – Singaporean Citizens – Permanent Residents (PRs) |

Not Entitled | – Foreign Employees |

It is important to note that permanent residents are subjected to Graduated CPF Rates during the first 2 years of obtaining PR status. From the 3rd year onwards, the rates will adjust back to that of a Singaporean Citizen.

Type of Employment (Provided Wage > $50/Month) | |

Entitled | – Full-time Employees – Part-time Employees – Casual Employees – Employees with more than 1 Employer – Employees (Family Members) |

Not Entitled | – Singaporeans and PRs Posted Overseas – Sole-proprietors / Self-employed / Partnerships – Limited Partnerships/Limited Liability Partnerships (Interns / Trainees) – Employees belonging to a Vessel (Master / Seaman / Apprentice), |

Full-time, part-time, and casual employees are all entitled to CPF contributions – provided their monthly wage is $50 and higher.

An employee who works more than 1 job is also entitled to CPF contribution from every one of his or her employers.

Even if the employee is your immediate family or relative, employers must contribute to their CPF regardless of their opinions on the matter.

Singaporean citizens and permanent residents posted overseas are not entitled to CPF contributions as they are subjected to different income schemes and taxes in their specific countries.

Sole-proprietors, self-employed, and partners are not legally considered a small business – however they are often classified under the umbrella term. They only need to contribute to their Medisave Account – which is calculated based on their annual net trade income earned.

Interns and trainees are not considered formal employers of a business. They are there to learn and pick up skills. The allowance that they earn is not subjected to CPF contribution.

Seaman and any crew working on a vessel, who are Singaporean Citizens and who have been employed under specific contract terms, are entitled to CPF contributions. However, those who are not employed under such terms or who are permanent residents are excluded from this. (TBC)

Payments That Are Included in/Excluded from Employer CPF Contribution

Payments | |

Included | – Basic Monthly Wage – Overtime Pay – Cash Incentives – Allowances – Bonus / Commissions – Payment in lieu of Annual Leave |

Excluded | – Termination Benefits – Reimbursement – Compensations |

Overtime pay only applies to non-workmen earning up to $2,600; and workmen earning up to $4,500. Visit MOM’s website for more information.

Cash incentives can come in the form of Good Performance and Long Service Awards.

Allowances include but are not limited to transport, food, education, festive gifts, etc.

Bonuses and commissions are to be considered. However, there is a cap on the amount that is used in computing total CPF contributions. (To be discussed further in this article)

Payment in lieu of annual leaves is not an option made available for every business. But those who do offer this option have to include it in CPF contributions.

Termination benefits can range from retirement gratuity to severance payment.

Reimbursement refers to expenses that employeees incure on behalf of the company. Employees are only entitled to reimbursing the funds used.

Compensations can be in the form of an Injury Insurance Payout as a result of an accident associated to the business.

Wage Classification

Ordinary Wages (OW) refer to the monthly wage that an employee earns.

Additional Wages (AW) refer to any wage that an employee earns that is not limited to a specific month of the year; or is given at intervals of more than 1 month.

Included Payments | Wage Classification |

Basic Monthly Wage | OW – Constant payment monthly |

Overtime Pay | AW – Not always applicable every month – There may be months in which the employee does not incur any overtime at all |

Cash Incentives | AW – Only received when an employee performs well or fulfils a certain objective |

Allowances | OW or AW – Allowances received monthly are considered to be Ordinary Wages – Allowances received at the end of the year or every two months are considered to be Additional Wages |

Bonus and Commissions | AW – Variable depending on monthly performance – Year-end bonus is not given on a monthly basis |

Payment in lieu of Annual Leave | AW – Generally a one-time payment for the whole year |

CPF Contribution Ceiling

CPF Ceiling Classification | |

Ordinary Wages (OW) Ceiling | Capped at $6,000 E.g. Ben’s Monthly Wage is $7,000 CPF Contribution will only consider OW = $6,000 |

Additional Wages (AW) Ceiling | Formula is $102,000 – Total OW for the Year E.g. Ben’s Monthly Wage is $7,000 $102,000 – ($7000 x 12) = $18,000 Ben received AW = $30,000 for the Year CPF contribution will only consider AW = $18,000 |

Employee and Employer CPF Contribution Rate

Employee’s Age | Employer’s Rate | Employee’s Rate |

55 and Below | 17% | 20% |

Above 55 to 60 | 13% | 13% |

Above 60 to 65 | 9% | 7.5% |

Above 65 | 7.5% | 5% |

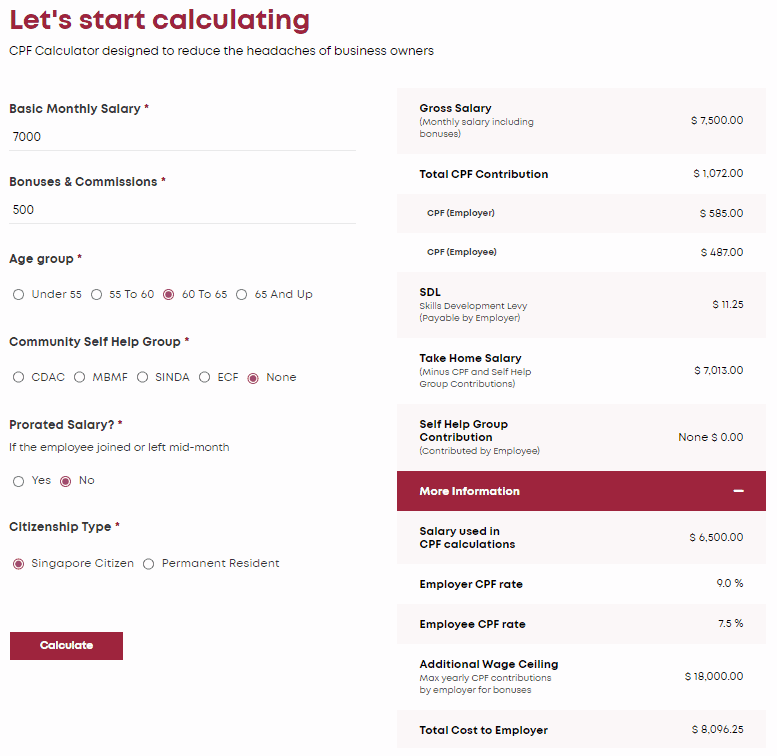

CPF Calculation

Calculating CPF contributions may seem confusing at first glance. However, there is a set formula to follow for all cases. You must also be aware of relevant information regarding your employees.

Case Study of Ben

- 62 Years of Age

- Singaporean Citizen

- Monthly wage is $7,000

- Given a Bonus of $500 for the Month

CPF Calculation Process for Ben

- OW = $6,000 (Exceeded OW Ceiling)

- AW = $500 (Yet to exceed AW Ceiling)

- CPF Contribution for Ben

- Employer Rate x (OW + AW) + Employee Rate (OW + AW)

- 9% x ($6,000 + $500) + 7.5% x ($6,000 + $500)

- $585 (Round Up to Nearest Dollar) + $487 (Round Down to Nearest Dollar)

- Final Sum = $1,072

Imagine doing these calculations for 10 employees. That is A LOT of work and room for error.

We at SBO have made our own Employer CPF Contribution Calculator to help small business owners calculate their CPF contributions quickly and accurately.

CPF Payment

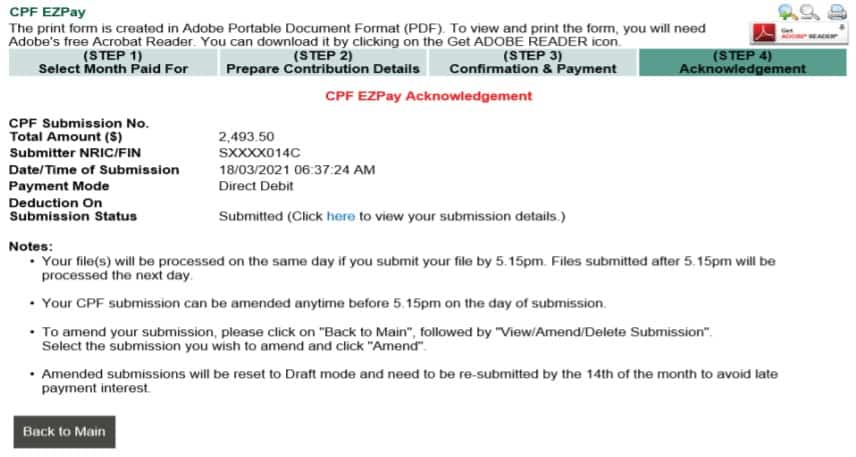

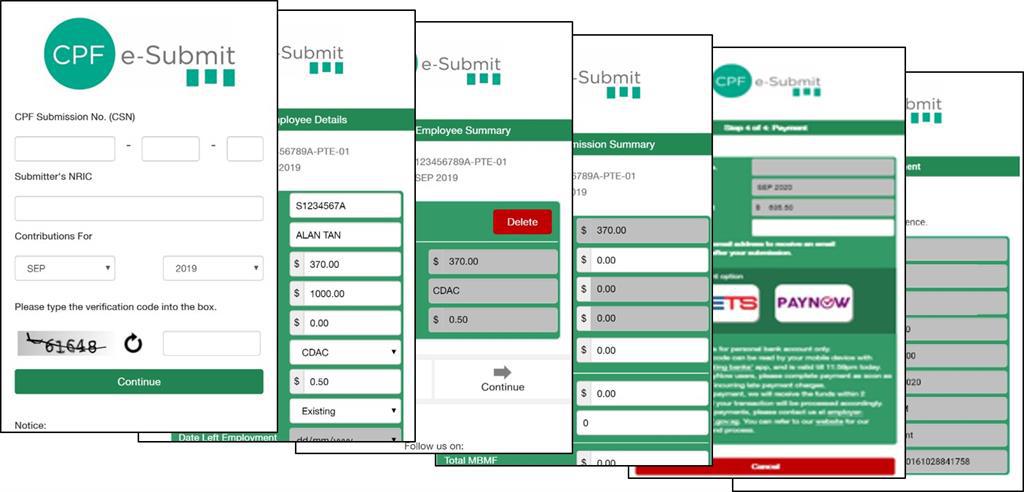

CPF EZPay is a completely free e-service provided by the CPF Board. Employers can input their employees’ CPF contributions details and make payment electronically.

Source: CPF Board

Registration Details

- SingPass/CorpPass account

- Unique Entity Number (UEN)

- Working Email Address

- Indicate Mode of Payment

Employee Information

- CPF Account Number

- Full Name

- OW and AW

- Date of Birth

- Singaporean Citizen or Permanent Resident

Modes of Payment

- Direct Debit / Giro

- PayNow / eNets

- AXS Stations

- Cheques

Direct Debit/GIRO allows users to schedule automated CPF payments every month. This helps eliminate the risk of late payment and incurring any penalties.

PayNow/eNets are also useful as they can be operated on mobile devices.

For businesses that may not be as digitalised, Cheques and AXS Stations could be more appropriate ways of payment.

When to Submit CPF Contributions?

Employer CPF Contributions are to be submitted by the last day of each month. Beyond that date, a 2 weeks grace period will be given.

This is because some businesses may not be able to process payroll and CPF contributions by the end of the month.

If payment is still not made by the end of the grace period, employers will incur a 1.5% late payment interest rate starting from the following month.

Common Problems When Submitting CPF Contributions and Solutions

Problems | Solutions | |

Over-payment | Transferring More than Required | Shift the Excess Funds to the Next Month Apply for a Refund |

Under-payment | Transferring Less than Required | Pay Off the Discrepancy |

Incorrect Payment | Incorrect CPF Submission Number Indicated Incorrect Month | Apply to the CPF Board to Alter the CPF Payment |

Late Payment | Not transferring the sum by the last day of the month | Send Payment during the 2 week grace period asap |

Tips and Help Tools to Optimise Employer CPF Contributions

Having a proper bookkeeping system is extremely important. You need to have a way to accurately and consistently track these payments so that you do not have to scramble when it is time to settle CPF Contributions.

Apart from outsourcing this to Freelance Bookkeepers, you can also consider investing in HR Tools and Softwares.

In order to prevent miscalculation, you can utilise tools such as our Employer CPF Contribution Calculator to accurately compute CPF contributions. Not only does it reduce the margin of error, but it also saves valuable time – allowing you to focus on growing your business.

When you get busy, you lose track of things. Do remember to mark it down on your planner. Alternatively, you can enlist the help of Google Calendar to track what needs to be done.

For any CPF-related queries, do visit the CPF Board for more information.

Conclusion

Employer CPF Contributions should be done in the most efficient and effective manner. To summarise, you need to have a good grasp on:

- Which Employees are entitled to CPF Contribution?

- Included/Excluded Payments

- CPF Ceilings

- CPF Calculations

- Common Problems and Solutions

- Tips and Help Tools

As your business develops, you need to be able to keep up with manpower growth.

Having a robust CPF system in place is indicative of how well your business is able to cope with Human Resource matters. Start inculcating good practices by optimising your Employer CPF Contribution system today.

Disclaimer

Please use this guide with discretion. In no event shall SBO be liable for damages, expenses, costs or loss of any kind (including without limitation any direct, or indirect, special, incidental or consequential damages, loss of profits or loss opportunity) howsoever caused as a result (direct or indirect) of, or in connection with, your use of this Website, or reliance on any information, materials, tools or online services provided in or available from this Website, irregardless of the form of action.

Explore More Content

Table of Content